Tuesday January 3, 2023

Happy New Year. I hope you had a good and relaxing holiday. I have included all of the main stories over the past week in this extended issue of BitDigest.

This week will be a short publication schedule as I am only planning to release BitDigest today and tomorrow. Next week will be back to a regular schedule.

◾ China is launching a “digital asset trading platform” for intellectual property and NFTs. (SCMP)

◾ Cameron Winklevoss issued an open letter to DCG’s Barry Silbert accusing him of negotiating in bad faith in an attempt to use public pressure to seek a resolution to Genesis’ suspensions. (Twitter)

◾ Valkyrie Investments proposed that it should become the new sponsor and manager of the Grayscale’s Bitcoin Investment Fund (GBTC). (Valkyrieinvest)

Government & NGO Actions

◾ The Central Bank of Turkey conducted the first-phase studies on the Digital Turkish Lira Network and plans to expand its trials to selected banks and financial technology companies in 2023. (Gov.tr)

◾ The Governor of Morocco’s Central Bank said a draft crypto regulatory framework has been prepared and will be presented to various stakeholders in the coming days. (Moroccoworldnews)

◾ The Micronesia islands of Palau is partnering with Ripple to introduce a national stablecoin. (Cryptoslate)

◾ The Securities and Exchange Commission of the Philippines’ issued a public warning against transacting with unregistered and unlicensed cryptocurrency exchanges. (Gov.ph)

◾ Japan’s Financial Services Agency is asking for feedback on regulations that could reverse a ban on the distribution of foreign stablecoins. (Pymnts)

◾ West Virginia became the first state in the country to digitize vehicle titles. (WV.gov)

◾ The Justice Department filed commodities fraud and manipulation charges against Ari Eisenberg for his role in attempting to steal $110 million from the Mango Markets decentralized exchange. (Courtlistener)

◾ The FBI is investing crypto trading service 3 Commas following reports that 100,000 user API keys were leaked. (Coindesk)

◾ CFIUS (Committee on Foreign Investment in the United States) warned that its ongoing review of Binance’s intended purchase of Voyager Digital’s assets "could affect the ability of the parties to complete the transactions, the timing of completion, or relevant terms." (Reuters)

Public Company Releases

◾ Galaxy Digital (GLXY) agreed to buy Argo Blockchain’s (ARBK) Helios Bitcoin mining facility for $65 million and $35 million in a loan package. (Cision)

◾ Greenidge Generation (GREE) amended its loan agreements with NYDIG and B Riley. (Greenidge)

◾ MicroStrategy (MSTR) added 2,500 bitcoin to its balance sheet bringing its total bitcoin holdings to 132,500 bitcoin acquired at an average price of $30,397 per BTC. (Twitter)

◾ The CEO of bitcoin miner Bitfarms (BITF) resigned and will be replaced by COO Geoffrey Morphy. (Bitfarms)

Restructuring, Losses and Legal News

◾ Sam Bankman-Fried is expected to enter a plea of not guilty at this morning’s hearing. (Reuters)

◾ Gemini and its founders, Tyler and Cameron Winklevoss, were sued by investors who had their assets frozen in the Genesis suspensions. (Bloomberg)

◾ Former Alameda Research CEO Caroline Ellison said she and FTX co-founder Sam Bankman-Fried knowingly misled lenders about how much the now-bankrupt trading firm was borrowing from the cryptocurrency exchange. (Bloomberg)

◾ The Securities Commission of the Bahamas said it seized over $3.5 billion in assets on behalf of FTX customers in November. (SCB)

◾ FTX is disputing claims by Bahamian regulators that they are holding $3.5 billion in FTX assets saying the value of the seized assets was only $296 million. (Reuters)

◾ The judge overseeing the FTX fraud case recused herself due to a potential conflict of interest – her husband is a partner at a law firm that previously represented FTX – with Judge Lewis Kaplan assigned to the case. (Thehill)

◾ Sam Bankman-Fried borrowed more than $546 million from Alameda Research to buy a 8% stake in Robinhood (HOOD). (Fortune)

◾ Federal prosecutors are looking into crypto wallets that are believed to belong to FTX founder Sam Bankman-Fried. (Bloomberg)

◾ BlackRock (BLK) provided Core Scientific with $17 million in debtor-in-possession loans. (Bloomberg)

◾ FTX’s Japanese subsidiary plans to customer to begin withdrawing assets on the exchange in February. (Reuters)

Protocols, Applications & Business News

◾ Crypto lender Vauld called off its potential acquisition with Nexo. (Coindesk)

Metaverse Briefings & Activations

◾ Fidelity filed trademark application for its investment and real-estate services in the metaverse. (Twitter)

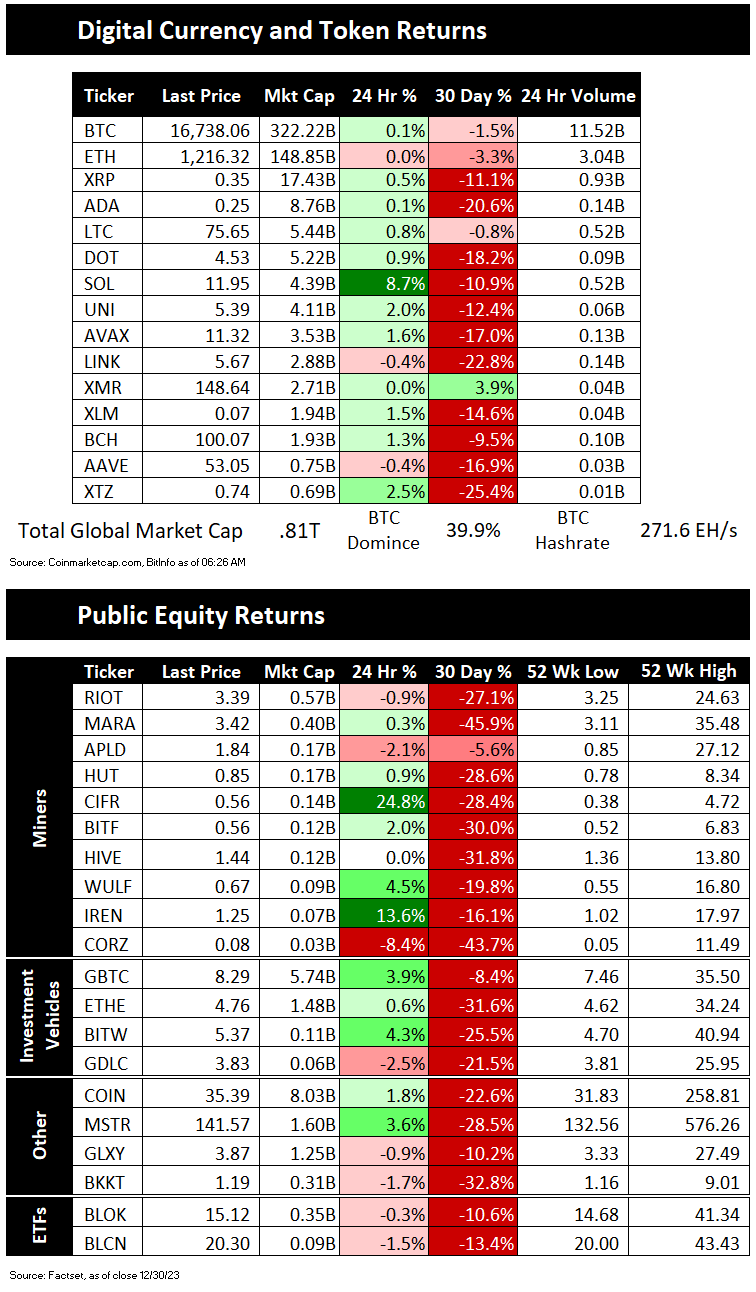

Market Data

◾ Bitcoin’s difficulty fell 3.59% in the latest adjustment yesterday. (BTC.com)

Exchange, Custody and Product Updates

◾Kraken announced a decision to cease its operations in Japan and deregister from the Financial Services Agency (JFSA) as of January 31, 2023. (Kraken)