Thursday June 2, 2022

◾ The Department of Justice issued its first insider trading charges involving digital assets against a former product manager at NFT platform OpenSea who front-ran OpenSea listings using anonymous wallets and OpenSea accounts. (Justice.gov)

◾ South Korea is launching a Digital Assets Committee to oversee crypto exchanges. (Decrypt)

◾ The European Supervisory Authorities (EBA, EIOPA and ESMA – ESAs) have recommended that crypto exchanges should lose their licenses if found to have breached anti-money laundering and terrorist financing rules. (ESMA)

Government & NGO Actions

◾ Germany’s financial regulator BaFin said crypto companies looking to be regulated much keep data secure and meet money laundering guidelines in order to receive regulatory approval. (Coindesk)

◾ The Bank of England’s executive director for markets explained that “balance sheet considerations do not… present any 'redline' arguments against CBDC adoption” adding that stablecoin issuers will need to be regulated under the same standards as banks. (Reuters)

◾ New York Fed President John Williams warned that it is “critical that [the Fed] understand how [digital] transformations could affect the economy and the financial system, as well as monetary policy implementation." (Reuters)

◾ The SEC has released the “Investomania” public service campaign using videos of game shows to educate investors in a playful way that investing is not a game and that they should do their due diligence when making investment decisions – one of the spots is a celebrity endorsement on crypto. (SEC)

◾ The Financial Planning Standards Board (FPSB), the issuer of the Certified Financial Planner certification, has issued a set of recommendations to the International Organization of Securities Commissions including that a financial knowledge test be developed for investors allocating capital to digital assets. (FPSB)

Public Company Releases

◾ Gamestop (GME) y-o-y revenues increasd 8% to $1.3 billion during the three months ending April 30th but reported a larger than expected operating loss of $153 million benefited by a $76 million sale of IMX tokens; the company stated its digital asset wallet is intended to launch in Q2. (Gamestop)

◾ Bitfarms (BITF) reached a total has rate of 3.4 EH/s generating 431 new bitcoin in May. (Globenewswire)

◾ Digihost (DGHI) mined 70 bitcoin in May bringing its total digital asset inventory value, including BTC and ETH, to $22.3 million. (Globenewswire)

◾ Cathedra Bitcoin (CBIT) reported revenue from its mining operations of approximately $3.11 million bringing its total hash rate to 155 PH/s during Q1’22. (Cathedra)

◾ Chipotle Mexican Grill (CMG) now accepts digital currencies at all of its nearly 3,000 US restaurants. (Restaurantbusinessonline)

Protocols, Applications & Business News

◾ Apple (AAPL) has created a package of AR viewable trading cards for next weeks annual worldwide developers conference causing speculation that this could be the companies first foray into NFTs. (Macrumors)

◾ The venture arm of Binance has launched a $500 million early stage fund with outside capital. (Bloomberg)

◾ The alleged administrator of the dark web marketplace Hydra refuses to give Russian authorities access to his digital wallet prohibiting them from seizing an expected cache of millions of dollars in digital assets. (News.bitcoin)

◾ FTX founder and CEO Sam Bankman-Fried has signed the Giving Pledge committing to give the majority of his wealth to philanthropy. (Twitter)

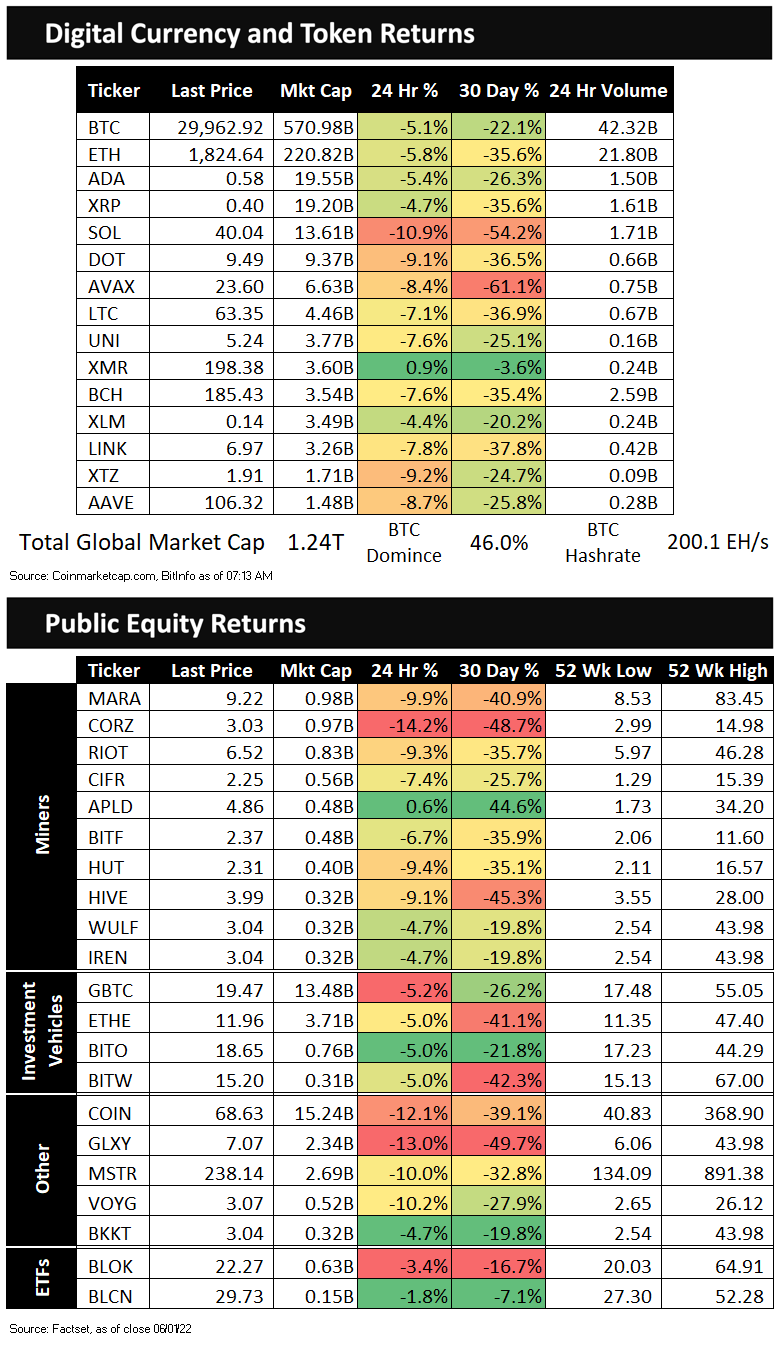

Market Data

◾ Decision making assistance site Finder released a study on play-to-earn adoption finding that gamers in India and Hong Kong are most active in the new genre our playing Americans by 3 times. (Finder)

Thoughts on the Ecosystem

◾ Netscape and a16z founder Marc Andreessen has compared Web3 to the start of the internet for the first time adding that he’s “never said it about any other kind of technology, because I just wanted people to know like I don’t take the comparison lightly.” (Cointelegraph)

◾ Robert Whaley, the creator of the Cboe Volatility index, is recommending that the SEC approve the conversion of the Grayscale Bitcoin Trust (GBTC) into an ETF suggesting the Coindesk Bitcoin Price Index, which GBTC tracks is a “near perfect substitute” to the Chicago Mercantile Exchange’s Index of Bitcoin futures. (Bloomberg)