Monday December 12, 2022

◾ The SEC filed its first legal brief in the GBTC spot ETF suit arguing “there [was] no inconsistency in the Commission’s disapproval of Grayscale’s spot ETP despite having approved two CME bitcoin futures ETPs.” (Grayscale)

◾ The CEO of crypto news source The Block resigned after revealing that he had secretly received $27 million in financing from Sam Bankman-Fried to support his 2021 management buyout. (Medium)

◾ The Bank of England is seeking applications for a proof of concept for a CBDC wallet. (Gov.uk)

Government & NGO Actions

◾ Senator Tom Emmer (R-MN) continued his attack against SEC Chair Gary Gensler saying he “repeatedly dodged Congress at the expense of investors” forcing the Senators to learn about the agency’s regulatory activities through the media. (Twitter)

◾ Calling cryptocurrencies a “synthetic,” Senator Jon Tester (D-MT) said he sees “no reason why [they] should exist” adding if its regulated, “it may give it the ability of people to think it's real." (NBC)

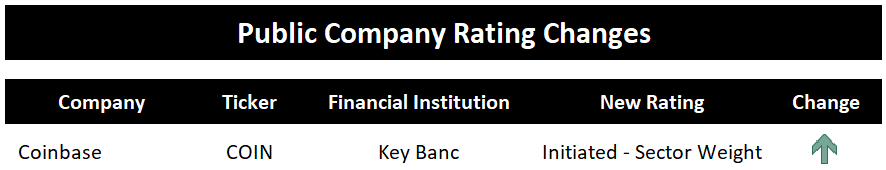

◾ The US Supreme Court has agreed to hear an appeal by Coinbase (COIN) in two customer lawsuits the company is looking to resolve through private arbitration. (CNBC)

◾ In late November, the Italian Supreme Court ruled that cryptocurrencies fall within the broad domestic category of financial products: requiring invested capital, an expectation of a financial return, and an assumption of financial risk. (Hoganlovells)

Public Company Releases

◾ Trading in shares of Argo Blockchain (ARBK) were temporarily suspended Friday afternoon “pending the release of material news.” (Nasdaq)

◾ Grayscale Investments announced its Decentralized Finance Fund is now trading on OTC Markets under the ticker: DEFG. (Globenewswire)

◾ Blank check company Crypto 1 Acquisition Corp (DAOO) said it does not believe it will consummate an initial business combination in the allotted time and will redeem its issued shares. (Businesswire)

◾ Abri SPAC 1 (ASPA) is seeking to extend the date in which it needs to consummate a merger agreement following the termination of its initial plan merger with institutional crypto trading platform Apifiny. (Businesswire)

◾ Crypto trading platform FalconX revealed it has 18% of its assets tied up in the FTX bankruptcy. (FalconX)

Restructuring, Losses and Legal News

◾ The Wall Street Journal is reporting that Alameda attempted to drive down the price of tether (USDT) and other digital currencies in the days before FTX’s collapse in an attempt to lower the value of its liabilities tied to these coins. (WSJ)

◾ Bahamian regulators have asked the FTX bankruptcy judge to force the company’s management to provide access to FTX’s Amazon and Google Cloud databases. (CNBC)

◾ US Prosecutors are investigating whether hundreds of millions of dollars were improperly transferred to the Bahamas around the time of FTX’s bankruptcy filing. (Bloomberg)

◾ Former Alameda Research CEO Caroline Ellison hired Stephanie Avakian, a former enforcement division chief at the SEC to represent her in her upcoming case. (Bloomberg)

◾ A class action suit has been filed naming multiple influencers and celebrities for promoting the Bored Ape Yacht Club and failing to disclose their relationship to its developer Yuga Labs. (Lawow)

Protocols, Applications & Business News

◾ Terraform Labs founder Do Kwon the target of an international manhunt is reportedly hiding in Serbia. (Bloomberg)

◾ Crypto.com released its Proof-of-reserves simply providing a stated reserve ratio for each major asset rather than sharing its full balance sheet. (Crypto.com)