BitDigest - Wednesday June 2, 2021

Crypto prices start new attempt to break recent resistance levels

Russia sees crypto as future of the financial system

Beijing to provide $6.2 million in latest digital yuan give away

Could Cyberattacks Lead to an Anti-Crypto Response?

I do not view regulation as a negative, I would prefer a lighter-touch government, but I see a real need for clarity regarding digital currencies.

About 2 years ago, Libra (now operating as Diem) issued its white paper igniting global regulators on a path towards creating their own sovereign digital currencies. Since then central bankers have made statement after statement, both questioning and supporting cryptocurrencies, but as these statements have evolved starting with original comments about crypto’s use to facilitate illicit activities, it seems clear that central bankers may not be drinking the Kool-Aid or taking the red pill (see below) but they see the benefits many of us have been praising and will be issuing their own form digital money in the future.

Regulators and law enforcement officials are also now recognizing the transparent characteristic of digital currencies, but what still concerns me – what is keeping me up at night – is the fear that the Biden Administration may respond to the ongoing cyberattacks against US companies and critical infrastructure by targeting the payment rails.

Yesterday’s headline that “One-Fifth of U.S. Beef Capacity Wiped Out by JBS Cyberattack” is alarming. This is not a ‘crypto-thing’ but the reality remains that digital currencies are in some-way helping facilitate these attacks and the US is being forced to respond. The response will likely come in an offensive form similar to Stuxnet, the US-Israeli virus that targeted Iran’s nuclear program, but it could also come in the form of a more public defensive response by targeting digital currencies.

I do not believe digital currencies will be banned – we can argue whether this is even feasible another day – but I am concerned that regulators may use these attacks to drive new levels of compliance around KYC and AML that could hinder the adoption of private coins and tokens.

Note: There has been no mention that I can find in the press as to which cryptocurrency the alleged Russian hackers have requested.

The Headlines

Digital Currencies are the Future for Russia's Financial System

Russia’s central bank governor Elvira Nabiullina believes digital currencies are “the future for our financial system because it correlates with this development of digital economy” but warns that a “common solution” is needed suggesting that “if each [central] bank creates [its] own system, technological systems with local standards, it will be very difficult to create some interconnections between these systems to facilitate all cross-border payments.”

Beijing plans to hold a lottery to give away 200,000 free online wallets with 200 digital yuan ($31.34) provided to each winner in the latest effort to test China’s digital currency electronic payment.

CAN Increases Hash-Power Sales by 122%

📈Chinese mining rig supplier Canaan (NASDAQ: CAN) sold a total of 2 million Thash/s during Q1’21 generating revenue of RMB402.8 million (US$61.5 million) and net income of RMB1.2 million (US$0.2 million).

📈ETC Group announced that its BTCE bitcoin will become the first cryptocurrency backed exchange traded product (ETP) to trade in the UK when it is added to the Aquis Exchange Multilateral Trading Facilities in London and Paris starting June 7th.

📈According to Coindesk, Overstock’s (NASDAQ: OSTK) tokenized-security, alternative trading system platform tZero is shopping itself looking for a suiter to help bring the company to the next level. An alternative option could be a SPAC.

Standard Chartered to Launch Digital Asset Exchange

The venture arm of British multinational bank Standard Chartered is planning to launch a UK-based, digital asset brokerage and exchange platform for institutional and corporate clients in the UK and Europe.

Makara Releases Mobile Crypto Robo-Advisor App

SEC registered crypto robo-advisor Makara has launched a mobile app to provide investors with access to digital currencies through index-like baskets. As of this morning, there are over 25,000 people on the waiting list to be granted access.

Daymak Introduces EV with Mining

Canadian light electric vehicle manufacturer Daymak may have beaten Elon to the punch and has announced that its upcoming Spiritus electric car – expected to launch in 2023 – will allow drivers to mine bitcoin (BTC), ether (ETH), cardano (ADA), and of course dogecoin (DOGE) while in park.

MLB Partners to Issue Lou Gehrig NFT

Following its past entrance into NFT’s with Lucid Sight’s MLB Crypto, Major League Baseball announced a new long-term agreement with with digital collectible company Candy Digital to offer a one-of-a-kind Lou Gehrig NFT featuring the Iron Horse’s “Luckiest Man” speech to be released on July 4.

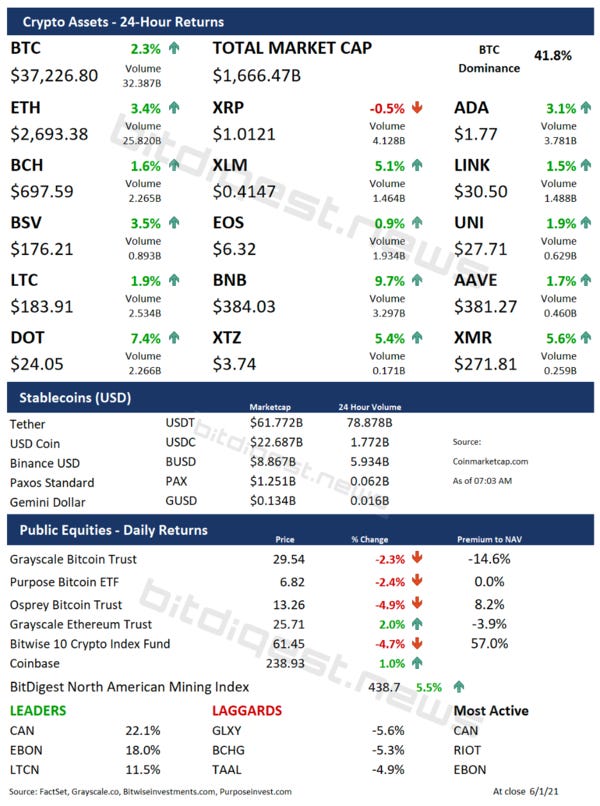

Market Data

Advisors Increase Use of Crypto in Response to Clients

A survey by the Financial Planning Association finds that the number of clients asking their financial advisors about cryptocurrencies has jumped to 49% compared to 17% last year. 14% of the surveyed advisors are currently using or recommending an allocation to crypto with 26% planning to increase how much they use and recommend cryptocurrencies over the next 12 months.

Exchange, Custody and Product News

Coinbase Card to Accept Apple and Google Pay

📈Coinbase (NASDAQ: COIN) announced that its credit card is now usable with both Apple Pay and Google Pay and will pay up to 4% (1% in bitcoin and 4% in Stellar Lumens) in shopping rewards.

Coinbase Pro is adding support for dogecoin (DOGE) and will begin trading on Thursday June 3rd if liquidity conditions are met.

Thoughts on the Ecosystem

Copper is a Better Substitute for Bitcoin than Gold

🐦📺Jeff Currie, Goldman Sachs’s global head of commodities research, believes that the cryptocurrencies are not a “substitute” to gold, but to copper suggesting that both BTC and copper are “risk-on” inflation hedges, while gold is viewed as a “risk off” safe haven.

Take the Red Bill and Try Bitcoin

Canadian asset manager Wellington-Altus released a paper on cryptocurrencies comparing the lead of faith by investors joining the “accelerating phase” of this “evolutionary process” of money to the “red pill” representing the recipient’s “willingness to learn a potentially unsettling or life-changing truth” that the Matrix’s rebel leader Morpheus offered Neo.

Daily Cartoon

In order to unsubscribe, click here.

If you were forwarded this newsletter and you like it, you can subscribe here.

Created with Revue by Twitter.

BitDigest is a weekday news update on digital currencies and blockchain technology for friends and partners of Parsons & Whittemore, a single family office based in Rye Brook, New York. Receipt of BitDigest is by approval of the Author. The commentary, analysis, opinions and recommendations in this newsletter represent the personal and subjective views of the Author, and are subject to change at any time without notice. The information provided in this newsletter is obtained from sources which the Author believes to be reliable. However, the Author has not independently verified or otherwise investigated all such information. Neither the Author nor any of the Author's affiliates make any guarantee or other promise as to any results that may be obtained from reading this newsletter. While past performance may be analyzed in this newsletter, past performance should not be considered indicative of future performance. No reader should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. The Author is not making a solicitation or offer to buy or sell any securities of any kind.