BitDigest - Monday October 9, 2017

Bitcoin (BTC) continued to strengthen and rose above $4,600 before declining to $4,584. BTC remains up 2.9% on daily volume of $1.4 billion.

The 100 SMA appears safety above the longer-term 200 SMA so it would seem that the path of least resistance is to the upside. This would also mean the rally is more likely to continue than to reverse. The maintained gap between the two levels, would indicate steady upside momentum.

Ethereum (ETH) is holding at $304, but is showing weakness above the $300 level. ETH is down 1.9% on volume of $370 million. (6:10 AM EST)

* * * * * * * * * *

Another Bitcoin ETF has been withdrawn. REX Exchange Traded Funds withdrew their filing to introduce the REX Bitcoin Strategy ETF and the REX Short Bitcoin Strategy ETF. REX noted that the SEC policy is to not review a registration statement for a fund where the underlying instruments in which the fund intends to primarily invest are not yet available; these derivatives platforms are expected later this year. The revised COIN ETF led by the Winklevoss brothers is still-in-review by the SEC.

* * * * * * * * * *

Several weeks ago, I reported on a discussion I had with a company looking to tokenize shares of Apple Inc. My problem was that the CEO of this company argued that the tokenized share of a security would not be considered a security. The Financial Times is now reporting on this company, LA Token. The company is now saying their tokens are actually just utility coins, for future platform usage such as assets tokenization. A future contract? But don’t worry, the company continues to repeat what the CEO told me, “US investors cannot participate.”

* * * * * * * * * *

On Friday, CNBC reported ‘where the jobs are this month and they are in the blockchain.’ Citing the $4.5 billion invested in private blockchain companies this past year, CNBC stated that many of these companies are looking for qualified workers. The report is correct in its general commentary, but completely overlooks the negative impact blockchain’s gains in efficiency will have on the average worker.

Blythe Masters, CEO of Digital Asset Holdings stated she believes blockchain’s impact will go far beyond the 5–10% of employees that she says “any well-disciplined organization will naturally try to squeeze out” in the process of improving processes. Instead, she estimates that 30–60% of jobs could be rendered redundant by the simple fact that people are able to share data securely with a common record.

David Yermack, professor of finance and business transformation at NYU’s Stern School of Business agrees saying “when you think of anyone who is keeping track of assets, I’d say their job is very much at risk.” Immediate jobs in jeopardy include those involving tasks such as processing and reconciling transactions and verifying documentation.

* * * * * * * * * *

Dragonchain, a private blockchain protocol, originally developed at Disney’s Seattle offices, initiated an ICO earlier this month and plans to allow investors to purchase “dragon” tokens through November 2nd. This ICO is starting to get media attention, not because of its technical platform, but because Disney is behind it. The problem is Disney is no longer involved. Although developed and now managed by former Disney engineers, Disney decided to release the protocol as an open-sourced license and is no longer supporting the project.

Curated News

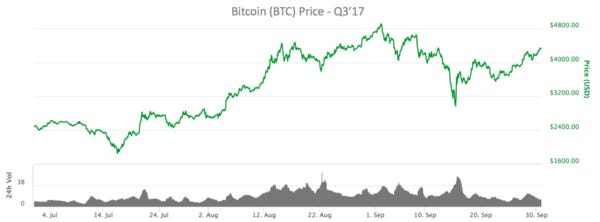

Bitcoin's Price Rises More Than Rival Digital Currencies in Q3

Bitcoin was the top performing digital currency out of the top five by market cap during the third quarter; it was up 74%. (See Chart of the Day below) (Bitcoin Cash, the digital currency created after Bitcoin split, was not included as it did not trading the entire quarter.) The third quarter marked a sharp contrast to the prior period as people shifted away from altcoins back into Bitcoin. “There was risk in the altcoins, people thought they were overvalued and cycled back into Bitcoin as a more sensible store of value.”

Bank of England Accelerator Announces Blockchain Proof of Concepts

The BOE’s Fintech Accelerator announced it is working with Chain on a Proof of Concept (POC) focused on a key tradeoff in distributed ledger technology (DLT) design to the extent to which DLT based systems can be configured to enable privacy among participants while maintaining the data on a share ledger. Their work on DLTs has helped the BOE better understand how financial networks may operate safer and more efficiently in the future.

tZERO ICO Will 'Raise a Fortune', Predicts Overstock CEO

Patrick Byrne confirmed that the SEC-compliant token exchange and marketplace led by its subsidiary, tZERO, will hold an initial coin offering (ICO) by Thanksgiving. Byrne predicts the tZERO ICO could “easily” raise as much as $200 million to $500 million, potentially breaking the record for token sale fundraising. Customers will be able to use the platform’s native token to pay for access to the FINRA- and SEC-compliant ICO marketplace.

Bitcoin’s Bubble Could Lead to Collateral Damage

As the perceived Bitcoin bubble grows, analysts say, a crash has a greater chance of affecting investor sentiment. Tech and financial “companies who are relying on [digital currencies] for business, and those who have put a significant investment into the [blockchain] infrastructure would be the first” to suffer collateral damage.

Fundstrat Rolling-out Digital Currency Indexes

Fundstrat Global Advisors is launching five separate indexes to track Bitcoin and other digital currencies. The indexes will track a total of 630 digital currencies, divided into five groups by market capitalization and trading volume. They are intended for institutional investors to better understand the evolution and behavior of crypto-currencies.

Chart of the Day

BTC gained 74% during Q3'17

In order to unsubscribe, click here.

If you were forwarded this newsletter and you like it, you can subscribe here.

Created with Revue by Twitter.

BitDigest is a weekday news update on digital currencies and blockchain technology for friends and partners of Parsons & Whittemore, a single family office based in Rye Brook, New York. Receipt of BitDigest is by approval of the Author. The commentary, analysis, opinions and recommendations in this newsletter represent the personal and subjective views of the Author, and are subject to change at any time without notice. The information provided in this newsletter is obtained from sources which the Author believes to be reliable. However, the Author has not independently verified or otherwise investigated all such information. Neither the Author nor any of the Author's affiliates make any guarantee or other promise as to any results that may be obtained from reading this newsletter. While past performance may be analyzed in this newsletter, past performance should not be considered indicative of future performance. No reader should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. The Author is not making a solicitation or offer to buy or sell any securities of any kind.