BitDigest - Monday October 4, 2021

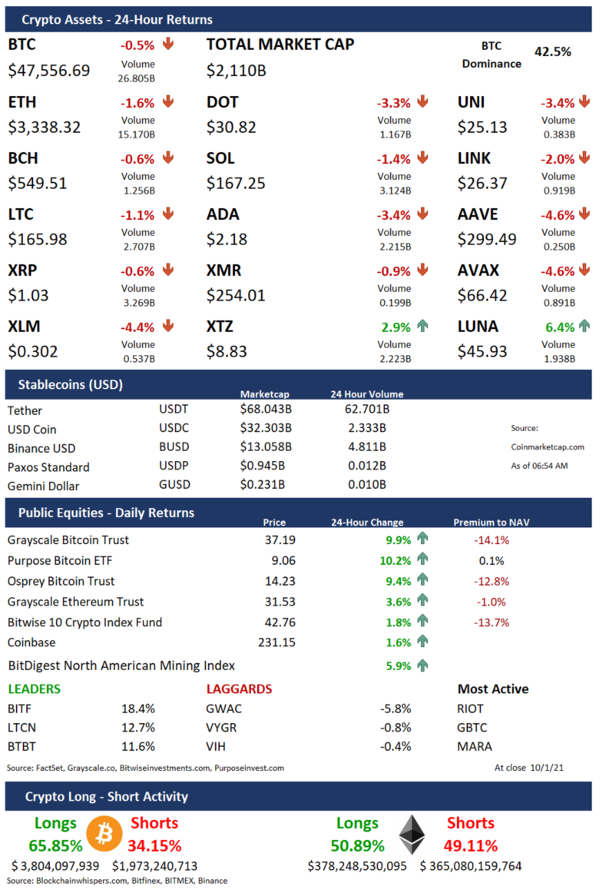

Crypto prices show slight decline after Friday’s market jump

White House looking to impose special-purpose banking charter on stablecoin issuers

The SEC has delayed its opinion on 4 bitcoin ETF applications until the end of the year

The Headlines

Biden Administration Looking to Regulate Stablecoin Issuers

The Wall Street Journal is reporting that the “Biden administration is considering ways to impose bank-like regulation on the cryptocurrency companies that issue stablecoins” and is “expected to urge Congress to consider legislation to create a special-purpose charter for such firms that would be tailored to their business models.”

White House to Hold Global Summit Under Counter-Ransomware Initiative

Under the new Counter-Ransomware Initiative, the White House plans to gather officials from 30 countries to discuss the threat of ransomware and cyber-crimes.

'Cryptoization' Threatens Financial Stability in Emerging Markets

The International Monetary Fund warned that the emergence of digital currencies could cause the “cryptoization” of emerging market economies, potentially undermining exchange and capital controls and upsetting financial stability.

The Central Bank of Nigeria has delayed the release of the e-naira following a sudden trademark litigation over the “eNaira” name and the decision to better prepare the release for people in rural areas and the unbanked population.

SEC Wants More Time to Review Bitcoin ETFs

The Securities and Exchange Commission has extended the review period on four bitcoin ETFs: Global X, Valkyrie, Wisdom Tree and Kryptoin until later in the year

The central bank of Laos will start to explore the issuance of a central bank digital currency as early as this month.

El Salvador Offers $0.20/gallon Discount for Bitcoin Payments

To generate further adoption of bitcoin in his country, El Salvador’s President Nayib Bukele announced a fuel subsidy of $0.20/gallon to anyone who pays for gas using the digital currency from their Chivo wallet.

Brazil Increases Penalties on Crypto-Crimes

Brazil’s lower house of Congress has passed a bill that boosts the fine on criminal activity using cryptocurrencies from one-third of the laundered funds to two-thirds, and increases the minimum prison term from 3 to 4 years.

French Regulators Issue Warning Regarding Unregulated Company Websites

France’s chief market regulators: Autorité des Marchés Financiers (AMF) and Autorité de Contrôle Prudentiel et de Résolution (ACPR) have updated their black lists of websites offering investments in the unregulated foreign exchange market and in derivative products whose underlying assets include crypto-assets, without being authorized to do so.

Kyrgyzstan Raises Electricity Tariff on Crypto Miners

The government of Kyrgyzstan has updated its electricity rate to “ensure the stable and reliable functioning of the energy sector” and will double the tariff charged on electricity used by digital currency miners to a new level of 12.5%.

Crypto Mining Causing Electricity Shortage in Kazakhstan

The government of Kazakhstan has identified crypto mining as the main culprit causing a nation-wide electricity shortages as consumption has surged 7% in the Central Asian country.

HIVE Announces Record Quarterly Revenue

Digital currency miner Hive Blockchain (NASDAQ: HIVE) generated revenue of $37.2 million, a year-over-year gain of 466%, reporting adjusted EBITDA of $29.5 million in the first quarter of fiscal 2022.

EBON Reports Revenue Increase of 65% in H1'21

Crypto miner and equipment manufacturer Ebang International INASDAQ: EBON) reported revenue of $18.3 million with a loss from operations of $4.9 million for the first 6 months of 2021. Management believes mining can help offset the negative impact of bitcoin’s price on the sales of equipment.

Bitfarms (NASDAQ: BITF) provided a production and mining update for the third quarter of 2021 reporting bitcoin production grew by 1,050 BTC during the 90 day period building the total holdings to over 2,300 BTC.

Grayscale Adds SOL and UNI to GDLC

Grayscale, the largest digital currency asset manager, has rebalance its diversified fund component weighting on its Large Cap (OTCQX: GDLC) and DeFi funds lowering the allocation in GDLC to bitcoin cash (BCH) and litecoin (LTC) and replaing it with solana (SOL) and uniswap (UNI).

Exchange, Custody and Product News

Coinbase Announces Phishing Attack and Pledges to Replace All Stolen Funds

Coinbase (NASDAQ: COIN) informed customers that during the second quarter over 6,000 customer had funds stolen from their accounts through illicit phishing attacks, but the company has decided to replace the full value of the stolen funds.

KuCoin Shutting Door to Chinese Traders (Again)

KuCoin announced it will remove all Chinese customers from its platform by December 31st; the Seychelles-based digital exchange previously announced a plan to cease operations for domestic Chinese traders in 2017, but Chinese customers remained on the platform.

In order to unsubscribe, click here.

If you were forwarded this newsletter and you like it, you can subscribe here.

Created with Revue by Twitter.

BitDigest is a weekday news update on digital currencies and blockchain technology for friends and partners of Parsons & Whittemore, a single family office based in Rye Brook, New York. Receipt of BitDigest is by approval of the Author. The commentary, analysis, opinions and recommendations in this newsletter represent the personal and subjective views of the Author, and are subject to change at any time without notice. The information provided in this newsletter is obtained from sources which the Author believes to be reliable. However, the Author has not independently verified or otherwise investigated all such information. Neither the Author nor any of the Author's affiliates make any guarantee or other promise as to any results that may be obtained from reading this newsletter. While past performance may be analyzed in this newsletter, past performance should not be considered indicative of future performance. No reader should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. The Author is not making a solicitation or offer to buy or sell any securities of any kind.