BitDigest - Monday November 13, 2017

“What a crazy year we had in digital currencies last week!”

Following Wednesday’s announcement to suspend the Segwit2x fork, rumors began circulating that a group of miners had 30% of Bitcoin’s (BTC) network hashing power and planned to go rogue. Over the weekend, Chinese miners activated a coordinated effort to clog the BTC mempool and move hashing power to Bitcoin Cash (BCH). BCH has always been a favored alt-coin for miners because its adjusting difficulty allows miners to play the system and drive down its difficulty making it easier to gain rewards. BCH also offers a larger block-size to allow for more transactions (8MB vs. BTC’s 1MB), therefore more future fees.

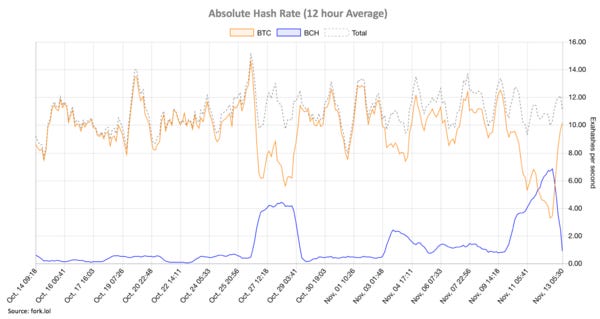

The amount of no-fee transactions added to Bitcoin (BTC) ’s mempool suddenly escalated to over 100 blocks (potentially a 16 hour backlog). BTC hashing which is typically at 10 Ehash/s dropped below 4.0 and BCH which averaged 1.03 Ehash/s during the month of October reached 6.75 and surpassed BTC’s hashrate for the first time. Last night the block reward for BCH was 3x, BTC. BUT this morning, calm has returned. See Chart of the Day below. The block reward for BCH is now 0.8 USD/Day for 1 THash/s vs. BTC’s higher 2.5 USD/Day.

After briefly reaching $7,800 following the Segwit2x announcement last week, BTC declined falling as low as $5,500 this weekend. BCH has rebounded and is trading at $6,492, up 3.8% over 24 hours. Volume is at $6.8 billion. This weekend’s 29% decline is significant, but less than the two most recent 60 day crashes: 38% in July and 40% in September – both of which recovered within days.

BCH’s price has increased 75% since Friday reaching a hight of $2,426 before declining to its current level of $1,140. 24 hour volume is $4.7 billion.

This weekend’s actions were intentional and meant to publicly display BTC’s market weakness. It culminated with a single transfer of 25,000 BTC to BCH last night reducing $2 billion in BTC’s network value.

BCH’s larger 8MB block size could be viewed as a solution to Bitcoin’s scaling issue, but this weekends occurrences clearly demonstrated the power centralized miners have to manipulate digital currency markets. Digital currencies trade 24-7, 365, but for the most part, US digital exchanges operate on US market hours. The Chinese miners clearly took advantage of this response to front run their actions.

It is also important to recognize the risk an 8MB block can add to the blockchain. Currently the BTC blockchain is gaining about 1 GB in size every week. Were BCH to achieve 8MBs for each new block, they could add over 50 GB to the blockchain during this same period (based on the high processing rates this weekend). This large application sizes would prohibit individual users from operating nodes (regardless of mining intentions).

BTC’s response needs to be greater usage of off-chain vehicles like the Lightning Network. These side-chain platforms will allow increased transaction rates to be recorded and the price to remain low.

Supporters of BCH believe they have a superior digital currency for commerce which can also be used as a store of value. The question the Bitcoin community will need to address is whether Bitcoin should just be a store of value – a digital gold – or should it be a store of value and a medium of exchange – a digital cash?

Gavin Andresen, a Bitcoin Core developer publicly designated by Satoshi Nakamoto to lead Bitcoin’s development efforts, tweeted the following yesterday: “Bitcoin Cash is what I started working on in 2010: a store of value AND means of exchange.” I am just not sure how he feels about the manner in which this weekend’s activities occurred.

* * * * * * * * * *

Ether (ETH) seesawed back and forth to the $300 level and is up 4.8% back to Friday’s level at $316. Volume is high at $1.4 billion.

Parity Technologies has not released any updates on its frozen wallets since Wednesday, but it is now being reported that this apparent accidental action may have been deliberate. Cappasity, an online marketplace for AR and VR 3D models that lost 3,264 ETH in the event, claims devops199 (the unknown actor in this story) made multiple attempts to extract and change ownership of ARToken and Polkadot smart contacts. It appears the user was maliciously poking around and eventually triggered the bug in Parity’s software.

* * * * * * * * * *

Bitcoin Gold’s (BTG) developers announced the new Bitcoin child-coin is live. The full client note is now downloadable. BTG is trading at $293 on its official first day with volume of $71 million. With the ongoing BTC-BCH battle, I imagine that BTG will be over looked, but BTC holders will eventually be asking for their free money. (6:20 AM EST)

Curated News

There was no coverage of the Bitcoin - Bitcoin Cash story in any of the major new sites this morning. News in itself.

Interactive Brokers Founder Fears Bitcoin Futures

Thomas Peterffy, founder and chairman of Interactive Brokers Group (NASDAQ: IBKR), is concerned that Bitcoin derivatives will introduce extraordinary volatility into the market that will be difficult to contain. He worries that small trading firms will offer the lowest margin rates to attract business, thus becoming weak links in the market’s defenses against risk, such as that posed by various products that track the CBOE Volatility Index, or VIX. Many investors are betting that the VIX will stay low. That wager could prove catastrophic if volatility suddenly surges, and stocks fall. Peterffy is recommedning the CME and the Options Clearing Corp., limit clearing members’ liability for peers at $100 million for Bitcoin futures. He also wants to isolate Bitcoin from other financial products, a step he says has already been taken for other volatility products.

Xapo President: Biggest BTC Companies May Move to BCH But BCH Move Not Sustainable

Xapo’s, a leading Bitcoin wallet and storage vault, President Ted Rogers tweeted, “my guess biggest companies r packing up 2 move to BCH or ETH & will take millions users & txs w/ them.” He followed up to state that “BCH has massive resources and [is] ready to deliver a user experience that can achieve mainstream adoption…[but] this BCH price move is far too fast to be real or sustainable…There is no weight YET behind BCH: virtually no users or businesses, nothing outside of power & pumped price.”

Overstock to Soar if it Sells E-commerce and Focuses on Blockchain

D.A. Davidson analyst Tom Forte says Overstock.com (NASDAQ: OSTK) could sell its e-commerce business and shares could rise more 60%. Overstock’s stock has surged in the last several weeks after CEO Patrick Byrne announced the company’s majority-owned subsidiary tZero is launching a digital coin-trading platform. The company has a license for a U.S. alternative trading system.

Bitcoin $400,000 Says Investing Guru Mark Yusko

Mark Yusko, founder and CEO of Morgan Creek Capital Management is calling for Bitcoin to eventually be worth $400,000. He believes Bitcoin “will change the supply and demand equation for banking. It is that big. I’m not surprised at all that bankers, financiers and Saudi Princes are coming out against it. This is a truly disruptive technology.” Yusko compared Blockchain and Bitcoin to the Internet thirty years ago, noting that it has the same capacity to ‘change everything.’ His prediction is for the long term of the digital currency.

Chart of the Day

Quote of the Day

“If you buy bitcoin cash, you are betting that China wants it to dominate. That’s a strategic and geopolitical bet.”- Willy Woo, Digital Currency Advocate and Analyst, @woonomic

In order to unsubscribe, click here.

If you were forwarded this newsletter and you like it, you can subscribe here.

Created with Revue by Twitter.

BitDigest is a weekday news update on digital currencies and blockchain technology for friends and partners of Parsons & Whittemore, a single family office based in Rye Brook, New York. Receipt of BitDigest is by approval of the Author. The commentary, analysis, opinions and recommendations in this newsletter represent the personal and subjective views of the Author, and are subject to change at any time without notice. The information provided in this newsletter is obtained from sources which the Author believes to be reliable. However, the Author has not independently verified or otherwise investigated all such information. Neither the Author nor any of the Author's affiliates make any guarantee or other promise as to any results that may be obtained from reading this newsletter. While past performance may be analyzed in this newsletter, past performance should not be considered indicative of future performance. No reader should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. The Author is not making a solicitation or offer to buy or sell any securities of any kind.