BitDigest - Monday June 4, 2018

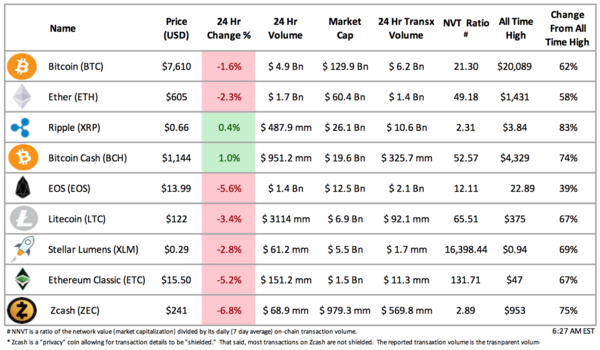

The REBEL coins are showing slight weakness this morning. The total market cap of all digital currencies is up 3%, $10 billion, over the weekend and appears to be giving back its two-day gains. Altcoins, led by EOS (which is down 5% this morning), have shown a recent pick up – bitcoin (BTC) dominance has declined and is now just holding above 40%.

BTC futures remained soft, similar to Friday, with less than 6,000 individually weighted bitcoin equivalent trading in the early morning session. Both June and September CME future contracts are trading up 2% today: June contracts are at $76,20 and September are trading at $7,650.

* * * * * * * * * *

ICO’s have raised over $9 billion so far this year compared to less than $4 billion in all of 2017. Led by EOS ($4 billion) and Telegram (<$2 billion), this increase has occurred even as regulators are tightening oversight of digital tokens.

* * * * * * * * * *

The original bitcoin network has been in operation since January 2009 without interruption. As a reminder of the strength of this decentralized network we just need to look at Visa. On Friday, the leading global payment transaction company experienced a service disruption which prevented many European transactions from being processed. A Visa spokesman said “the issue was the result of a hardware failure. We have no reason to believe this was associated with any unauthorized access or malicious event.” The system returned to full service over the weekend.

* * * * * * * * * *

Consensys, the blockchain venture production studio building decentralized applications on Ethereum, released a ‘State of the Ethereum Network’ posting. Meant as a ‘network snapshot,’ the company highlighted the popularity the network has gained since its 2015 release. Since 2017 alone, the word “Ethereum” has been included in over 110 million Google searches and the hashtag #ethereum is tweeted, on average, 20,000 times a day. Operationally, the network has processed nearly 240 million transactions, including 1.3 million transactions over 24 hours this past January. (It should be noted that Ethereum’s founder, Vitalik Buterin, just announced that Ethereum may one day be able to achieve 1 million transactions per second). There are 35 million unique addresses on Ethereum with approximately 17,000 nodes running the blockchain across six continents, making it the most decentralized blockchain platform in existence. (Bitcoin ran over 10,000 nodes over the past 24 hours). Most importantly, of the top 100 digital tokens by market cap, 94% are built on top of Ethereum and of the top 800 tokens, 87% are built on Ethereum.

* * * * * * * * * *

EOS, a decentralized protocol enabling the development, hosting, and execution of commercial-scale decentralized applications (DApps), was finally released this weekend. But with its new found success comes increased scrutiny. Prior to release, the stability of the platform was put into question when vulnerabilities were discovered in the protocol (these were supposedly patched). It has also been reported that just 10 addresses hold nearly 50% of all of its tokens. Yet, following the platforms $4 billion raise, expect to see and hear a lot about EOS. Block.one, the platform’s publisher just announced a new $50 million fund to accelerate the growth and development of the EOSIO blockchain ecosystem. This announcement comes on the back of news earlier this year that Block.one had partnered with Galaxy Digital on a similar $325 million fund. Stay tuned.

Curated News

Indonesia Adding Cryptocurrencies to Commodity Marketplace

The Bank of Indonesia (BI) has not yet recognize digital currencies as payment instruments, but the Trade Ministry’s Futures Exchange Supervisory Board has decided to start trading cryptocurrencies on the domestic stock market. The decision was made after the board was conducting a study on the matter in the last four months with a conclusion that cryptocurrencies deserved to be considered commodities. The Indonesian government will soon issue regulations that will rule on several issues including currency exchange companies, taxation and prevention of money laundering and terrorism financing.

New York State May Launch a Cryptocurrency Task Force

The state of New York is making progress toward establishing formal cryptocurrency rules that could ultimately bolster more widespread use of virtual currencies. The New York State Assembly proposed launching a digital currency task force to examine the burgeoning cryptocurrency and blockchain industries in the state. The proposed creation of a task force suggests that lawmakers expect cryptocurrencies to be a significant part of the financial markets going forward, despite the naysaying of skeptics who insist the industry will implode soon. If approved, the nine-person task force will provide a detailed report of their findings by December 2019

Blockchain Is '10 Times More Valuable Than the Internet'

China state broadcaster, China Central Television (CCTV), has announced that the economic value of blockchain is “10 times more than that of the internet.” The station’s Finance Channel featured an hour-long discussion that was for the first time dedicated to educating its wide audience-base on the concept, potential and risks of blockchain technology. The show also featured prominent global figures from the blockchain industry in both private and public sectors.

Japan's Financial Watchdog Issues Business Improvement Order

Japan’s Financial Services Agency (FSA) has issued business improvement order for domestic crypto exchanges. The FSA revealed that several of the crypto exchanges under its aegis are failing to apply sufficient Know-Your-Customer (KYC) checks to confirm the identity of their users and prevent ‘bad actors’ from trading. The regulator has also raised concerns about cases where it claims that customers’ assets are not being adequately separated from those of the exchange. The regulator’s new orders have been issued to twelve crypto exchanges in total, two of which are officially licensed exchanges and ten of which are ‘quasi-operators,’ meaning that their application for an FSA operating license is still pending.

Kik CEO Says Blockchain Isn’t For Everyone

The CEO of Kik, a freeware instant messaging mobile app that raised $100 million in an ICO last year, is not convinced that there are a whole lot of practical applications for blockchain technology other than Bitcoin and other cryptocurrencies. The genius of those currencies, Ted Livingston believes, is that they create “digital scarcity” that allows for a limited number of tokens to be created and exchanged across a network even if all the participants don’t trust each other. But that lack of trust, which makes it good for controlling transactions among strangers, is why it’s not great for so many other applications, he said. “What does blockchain do at the end of the day? It allows you to have a database that’s trustless. That can be applied in a bunch of ways, but most of those ways, you still need trust,” he said. The thing that excites Livingston about cryptocurrencies, though, is that the money involved has created an enormous incentive.

Binance Plans $1 billion Investment Fund

The world’s largest crypto exchange, Binance, has announced a $1 billion fund to back blockchain and crypto startups. The ‘Community Influence’ fund, which will be denominated in Binance’s BNB coin, will be aimed at both nascent startups and funds themselves. The firm identified that it is looking to work with proven managers who have previously managed over $100 million in assets, “we like small funds managed by experienced investors,” the company stated.

The company also revealed that its first incubation project will be Dache Chain, a new blockchain-based ride-hailing service in China. The company’s co-founder is Chen Weixing, the CEO of app development startup Funcity who initially founded Kuaidi Dache, a Chinese ride-hailing startup that eventually became Didi Chuxing, the country’s dominant service that forced Uber’s exit from China.

Tweet of the Day

In order to unsubscribe, click here.

If you were forwarded this newsletter and you like it, you can subscribe here.

Created with Revue by Twitter.

BitDigest is a weekday news update on digital currencies and blockchain technology for friends and partners of Parsons & Whittemore, a single family office based in Rye Brook, New York. Receipt of BitDigest is by approval of the Author. The commentary, analysis, opinions and recommendations in this newsletter represent the personal and subjective views of the Author, and are subject to change at any time without notice. The information provided in this newsletter is obtained from sources which the Author believes to be reliable. However, the Author has not independently verified or otherwise investigated all such information. Neither the Author nor any of the Author's affiliates make any guarantee or other promise as to any results that may be obtained from reading this newsletter. While past performance may be analyzed in this newsletter, past performance should not be considered indicative of future performance. No reader should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. The Author is not making a solicitation or offer to buy or sell any securities of any kind.