BitDigest - Monday December 4, 2017

Bitcoin (BTC) reach a new high above $11,850 yesterday afternoon before a sudden $1,000 decline. Separate news on both sides of the Atlantic that the UK and US governments are planning to expand AML policies to include digital currencies and exchanges brought a sudden shock which was echoed by most digital currencies.. Over night BTC, returned to its pre-run levels and is is unchanged on 24 hours at $11,430 on volume of $7.0 billion.

Ether (ETH) was trading at $480 before falling and finding support at $450. ETH is back at $465, down 1.8% on volume of $1.0 billion.

Bitcoin Cash (BCH) was nearing $1,650 before its afternoon fall, but unlike BTC and ETH, BCH jumped back but quickly lost its recovery and is trading at $1,542, down 4.4%, on volumes of $900 million.

Bitcoin Gold (BTG) is down 0.5% to $325 on weaker volume of $202 million. Claiming BTG has not been as easy as it was to claim other forked coins so many owners may have still not parsed the blockchain to claim their free money – volume numbers certainly support this assumption.

Ethereum Classic (ETC) followed a similar trading path as BCH. Following the AML news market weakening, ETC increased and is subsequently returning to support levels at $330. ETH is trading at $30.19. Following several days with volume above $900 million, volumes have declined and were $340 million on 24 hours. (5:55AM EST)

* * * * * * * * * *

The newest bitcoin child-coin is Bitcoin Diamond (BCD). Forked in late November, BCD futures have started trading and are currently at $44.46, down 10.8% on $6 million in volume.

BCD was launched by a group of miners who were unhappy with some of the perceived downsides of BTC. They forked the original code in an effort to improve the lack of privacy protection, improve the speed of transaction confirmations, and implement a more decentralized GPU derived, proof-of-work mining algorithm. Although there have been rumors that BCD is already trading on leading western exchanges and can be custodied on different hard wallets, this appears to be fake news, leading internet and tweeter posts to accuse BCD of being a scam.

Don’t worry, I do not plan to report on BCD daily unless it starts to receive market-traction.

* * * * * * * * * *

Bitcoin’s recent increases have made it the sixth most circulated currency in the world following the US dollar, Euro, Chinese Yuan, Japanese Yen and Indian Rupee. Bitcoin is now more valuable than the Russian Ruble, British Pound and Swiss Franc. Bitcoin needs to exceed $15,000 to move to number four on the list of currencies from the Bank for International Settlements and pass the Rupee. Bitcoin’s current market value is $191 billion.

The factor to consider is that while bitcoin is the world’s fastest growing currency, the number of individuals owning it and using it to pay for transactions is extremely small. If each of the 16.7 million bitcoin in circulation were owned by a different person, less than two-tenths of a percent of the global population would own bitcoin.

* * * * * * * * * *

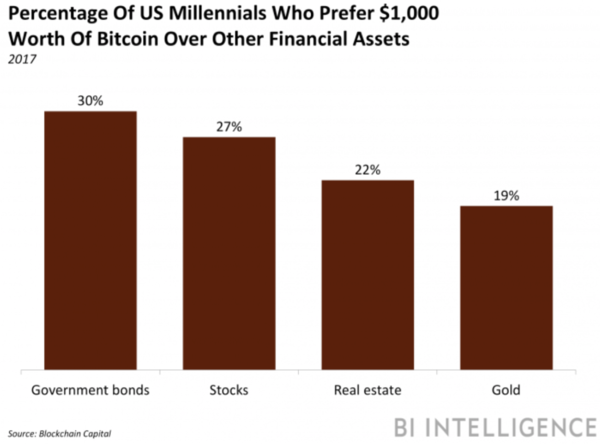

According to a recent survey by Blockchain Capital, millennials would rather own bitcoin than traditional asset classes. Of these investments, it is most interesting to see that 30% of millennials prefer bitcoin to government bonds. This may have as much to do with the supposed generational lack of trust in governments as an unwillingness to invest in the lower risk-adjusted returns provided by US government backed investment vehicles. (See Chart of the Day below).

Curated News

US Senate Moves to Criminalize Non-Disclosed Ownership of Digital Currencies

The US Senate Judiciary Committee is tackling the Combating Money Laundering, Terrorist Financing, and Counterfeiting Act of 2017 to criminalize the intentional concealment of a controlled financial account. The bill plans to amend the definition of ‘financial institution’ and ‘financial account’ to include: “an issuer, redeemer, or cashier of prepaid access devices, digital currency, or any digital exchanger or tumbler of digital currency.”

Note: Similar news came out of the UK over the weekend with Parliament seeking to expanding the reach of EU anti-money-laundering regulations to include digital currencies and exchanges.

India Doesn’t Recognize Bitcoin as legal

Indian Finance Minister, Arun Jaitley stated that India does not recognize digital currencies as legal tender. “Recommendations are being worked at. The government’s position is clear, we don’t recognize [digital currencies] as legal currency as of now,” he said. Jaitley previously informed Parliament there are no regulations governing virtual currencies, in India and the Reserve Bank of India has not given a license to any entity/company to operate such currencies.

Venezuela to Launch Oil-Backed Digital Currency

Venezuelan President Nicolas Maduro has announced the launch of the “petro” digital currency backed by oil reserves to shore up his collapsed economy. Few specifics about the currency launch or how the struggling OPEC member will pull off such a feat were offered, but he declared that “the 21st century has arrived!” “Venezuela will create a cryptocurrency,” backed by oil, gas, gold and diamond reserves, Maduro said, adding the petro will help Venezuela “advance in issues of monetary sovereignty, to make financial transactions and overcome the financial blockade.”

Note: This could be a very interesting use case, as the creation of the the petro would place control and oversight of all of the new currency in the hands of the Venezuelan government. As we continue to warn, this could bring the idea of a digital currency in this hyper-inflated economy from a ‘libertarian dram to a tyrannical nightmare.’

CFTC on Self-Certification of Bitcoin Products

The Commodity Future Trading Company (CFTC) issued a statement on self-certification for bitcoin future products and bitcoin binary options. CFTC Chairman Christopher Giancarlo said the CME, CBOE and Cantor have set an “appropriate standard for oversight over these contracts given the CFTC’s limited statutory ability to over the cash market for bitcoin”, however, he warns market participants to take note that the nascent underlying cash markets and exchanges remain unregulated and concerns remain regarding price volatility and trading practices in the markets. The CFTC also published a Fact Sheet providing a background on digital currencies, the self-certification process and key principles designed contract markets must adhere to with new contracts. The CFTC will continue to assess whether further changes are required for the contract design and settlement processes.

Confidence Supports Bitcoin's Subjective Value

Financial author and commentator Jim Rickards considers himself a “free market guy,” but he remains skeptical of bitcoin and is not a buyer. He does not trust the price action and expects it to eventually fall to zero, but as a utility token it will continue to find support from criminals, terrorists and tax evaders and therefore he believes it will end up “somewhere between zero and $200.” Rickards believes the digital currency markets are full of fraud with miners “painting the tape.” He is also concerned about the growing energy requirements of the protocol, but when asked about bitcoin’s valuation he supports a subjective valuation of the digital currency based on community support and confidence.

John McAfee Bullish on Bitcoin Reaching $1 Million by 2020

Cybersecurity pioneer and eclectic personality John McAfee raised his 2020 bitcoin price target to $1 million. McAfee who previously predicted bitcoin would reach $500,000 by the end of 2020, tweeted that he will eat his d**k if bitcoin’s price does not reach $1 million by the end of 2020. Craig Wright, who last year claimed to be Bitcoin’s creator, Satoshi Nakamoto, added that “Bitcoin from John is BTC + BCH [the value of bitcoin and all of its forks.] I think people are missing this.”

Chart of the Day

In order to unsubscribe, click here.

If you were forwarded this newsletter and you like it, you can subscribe here.

Created with Revue by Twitter.

BitDigest is a weekday news update on digital currencies and blockchain technology for friends and partners of Parsons & Whittemore, a single family office based in Rye Brook, New York. Receipt of BitDigest is by approval of the Author. The commentary, analysis, opinions and recommendations in this newsletter represent the personal and subjective views of the Author, and are subject to change at any time without notice. The information provided in this newsletter is obtained from sources which the Author believes to be reliable. However, the Author has not independently verified or otherwise investigated all such information. Neither the Author nor any of the Author's affiliates make any guarantee or other promise as to any results that may be obtained from reading this newsletter. While past performance may be analyzed in this newsletter, past performance should not be considered indicative of future performance. No reader should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. The Author is not making a solicitation or offer to buy or sell any securities of any kind.