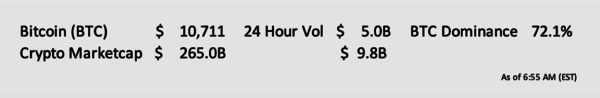

BitDigest - Monday August 19, 2019

Bitcoin recovers finding new support at $10,000.

Someone claiming to be the creator of Bitcoin publishes paper explaining origins behind his ideas

US lawmakers heading to Switzerland to discuss Libra

Bakkt announces physically settled bitcoin futures to launch on September 23rd

Rakuten releases free crypto app

The Headlines

Did Satoshi Nakamoto Reveal Himself

On Friday afternoon a press release was issued stating Satoshi Nakamoto, the anonymous creator of bitcoin, would be revealing himself on Sunday afternoon. Through a three part “reveal” Nakamoto planned to provide information about his real-life identify and divulge facts as his country of origin, education, professional background, and why he has yet to move any of his bitcoin.

As this is not the first time, someone has claimed to be Nakamoto, the industry looked at this release skeptically, however many of us looked forward to hearing what this person had to say.

On Sunday at 4pm, the first of three posts was released, the second and third post will be made on Monday and Tuesday at 4 respectively.

While Nakamoto did not exactly reveal his true identity – you have to wait until Tuesday for that – he did explain he grew up with a father who was a banker at Pakistani based United Bank Limited for 27 years. Nakamoto said he had a Pakistani nickname (“Shaikho”) which leads many of us to assume he is of Pakistani origin and he says he legally changed his name in the UK. He obtained a Masters in Computer Science during 1999-200 – he also promised to reveal what University he attended later.

Nakamoto claims to have been impacted by an experience in 2005 when he visited England but was unable to obtain a bank account as he lacked a permanent UK address. He was also impacted by the 1991 closing of the Bank of Credit and Commerce International (BCCI) by the Bank of England. “I learnt how unfair BCCI’s demise had actually been and that its ending had been in the hands of brutal and dirty corporate world policies and general underhanded politics,” he said. In homage to BCCI, he named bitcoin after it by taking a derivative of of its name: Bank of CredIT and COmmerce International.

He said he choose the name Satoshi due to its similarity to “Shaikho” using a using a code based on Chaldean numerology.

The final part of the first posting was a tribute to his supposed friend and partner Hal Finney – the person many people believe was actually Nakamoto.

I did a quick check of different words used in the new writing against words and phrases used in the original white paper and none of them matched so I remain skeptical as to whether this is the actual Satoshi Nakamoto, but the story is good in itself and I look forward to reading part 2 this afternoon.

US Lawmakers Plan to Discuss Libra with Swiss Regulator

Representative Maxime Waters (D-CA) plans to lead a delegation from the House Financial Services Committee to Switzerland to discuss Libra with the Swiss Federal Data Protection and Information Commission.

China's to Study Digital Currencies in Economic Zone Pilot

China’s Communist Party announced plans to initiate research on the use of digital currencies. The Central Committee hope to pilot a demonstration zone for ‘socialism with Chinese characteristics’ by supporting innovative applications such as digital money and mobile payments in the province of Shenzhen. The key areas of focus for the initiative will be a greater understanding of the impact on the modern industrial system and the role digital currencies can play in macro-financial markets.

FinCEN Reminds Casinos of Crypto Compliance Requirements

The director of the Financial Crimes Enforcement Network (FinCEN) has issued a warning to casinos about the acceptance of digital currencies. FinCEN director Kenneth Blanco highlighted recent guidance requiring casinos and card clubs to flag potential instances of money laundering, sanctions evasion, and other illicit financing purposes” using cryptocurrencies. ““There is a misconception that just because FinCEN has not publicly issued enforcement action against a casino or card club since last year that FinCEN is not looking at this financial sector… this is not the case,” he said.

US Customs Agency to Monitor Shipping Through Blockchain

The US Department of Customs and Border Protection (CBP) plans to begin using a blockchain to enforce intellectual property rights. The CBP is running a proof of concept to facilitate shipments based on known licensing relationships through the use of blockchain.

Investing >90% of Retirement Fund into Crypto is Prohibited

The Australian Tax Office (ATO) has begun issuing notices to investors reminding them of their ‘duty to comply with legal requirements to adopt investment strategies avoiding risky investments’ under the Self Managed Super Funds program. As such, investors cannot maintain more than 90% of their investments in a single asset class like digital currencies. The letters are meant to alert investors about potential exposure to concentration risk and regulatory breaches” the ATO explained.

Exchange and Product News

Bakkt, the Intercontinental Exchange’s digital currency platform announced it plans to release its physically delivered daily and month bitcoin futures contracts on September 23rd. Based on its approval by the New York State Department of Financial Services of Bakkt Trust Company as a qualified custodian, Bakkt will be now able to offer custody for physically delivered futures. Bakkt’s bitcoin futures will be exchange-traded on ICE Futures U.S. and cleared on ICE Clear US, which are federally regulated by the CFTC.

Binance Announces Venus Global Stablecoin Initiative

In an effort to forge new alliances and partnerships with governments and corporate, Binance has announced plans to release Project Venus, a stablecoin platform pegged to global fiat currencies. The leading global exchange hopes to use its existing ecosystem to experience to support new global collaboration.

Silvergate to Offer Crypto-Collateralized Loans

Silvergate Bank amended its IPO filing to say it plans to expand its Silvergate Exchange Network to offer loans collateralized by digital currencies. “This solution provides greater capital efficiency for institutional investor clients that wish to transact without needing to move liquidity on and off different exchanges. … Offering lines of credit would also improve liquidity within the order book of our exchange clients, enabling additional trading on their platforms, potentially reducing pricing arbitrage across exchanges and improving the stability of digital currencies,” the updated Form S-1 reads.

Rakuten Introduces Crypto Trading App

Rakuten has launched a a spot trading service for crypto assets in which users can conduct spot trading of crypto assets through a dedicated smartphone app. The Japanese internet company announced the release of the no-fee crypto app on Android with an iOS version to be released at a future date. Initially, the application will allow investors to trade bitcoin, bitcoin cash and ethereum.

In order to unsubscribe, click here.

If you were forwarded this newsletter and you like it, you can subscribe here.

Created with Revue by Twitter.

BitDigest is a weekday news update on digital currencies and blockchain technology for friends and partners of Parsons & Whittemore, a single family office based in Rye Brook, New York. Receipt of BitDigest is by approval of the Author. The commentary, analysis, opinions and recommendations in this newsletter represent the personal and subjective views of the Author, and are subject to change at any time without notice. The information provided in this newsletter is obtained from sources which the Author believes to be reliable. However, the Author has not independently verified or otherwise investigated all such information. Neither the Author nor any of the Author's affiliates make any guarantee or other promise as to any results that may be obtained from reading this newsletter. While past performance may be analyzed in this newsletter, past performance should not be considered indicative of future performance. No reader should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. The Author is not making a solicitation or offer to buy or sell any securities of any kind.