BitDigest - Friday November 8, 2019

Tezos up 35% this week, clocking best performance of large cap currencies, on announcement Coinbase will stake token

US FTC Commissioner calls for ‘urgency of intervention’ by Fed to act on real-time, round-the-clock payment services

President Maduro appears on TV with company claiming to be Tezor – company denies authenticity of report

The Headlines

Libra Underscore the Appetite of Real-Time Payments

Rohit Chopra, a commissioner at the US Federal Trade Commission has written to Board of Governors of the Federal Reserve System in support of the FedNow, real-time, round-the-clock payment service. While he is apprehensive about new programs like Libra, he stresses the it underscores the appetite for real-time payments and the urgency of intervention by the Federal Reserve. Chopra says this program will prevent a “Wall Street megabank monopoly. A public competitor will check private-sector abuse, and the Fed could provide proven benefits as a public competitor.

Television Segment Shows Maduro Meeting with Company Pretending to be Trezor

On Wednesday, Venezuelan President Nicolas Maduro appeared on television at a cryptofair with private crypto companies operating in Venezuela. The video was subsequently posted on Facebook. The video shows Maduro meeting with a firm claiming to be digital wallet supplier Trezor. Surprisingly, Trezor has publicly tweeted that it does not have official resellers in Venezuela, nor were they aware of the event.

Bank of Russia Against 'Private Money'

We are still waiting for the release of Russia’s crypto rules, but the Bank of Russia has now affirmed that it does not support ‘private money’ of any kind—specifically talking about cryptocurrencies. There are no talks of a ruble-backed stablecoin issued directly by the Bank of Russia. However, it seems that the country is actively following international developments in the hopes of discovering a model on how to best implement stablecoins.

Shanghai Leads Blockchain Trade Alliance

The government of Shanghai is partnering with financial institutions in the Shanghai E-port area to boost the use of blockchain for global trade. The Shanghai Municipal Commission of Commerce, Shanghai Customs, and representatives of 6 bank branches in the city — including the People’s Bank of China and Bank of Communications have signed an agreement to develop blockchain technology to help the city streamline processes related to international trade.

Silvergate Bank Trading on NYSE

Silvergate Bank has officially listed on the New York Stock Exchange. The crypto friendly California-based institution posted its first trade at $12.75 under the ticker of SI and closed at $12.52, up 4.3% during its first trading session.

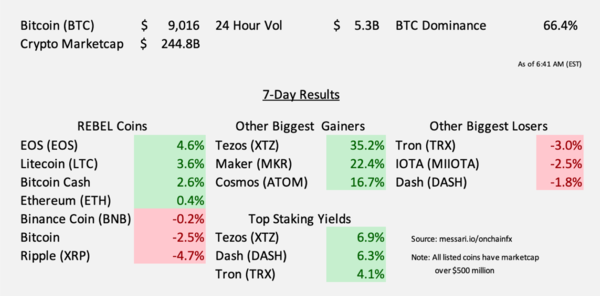

Market Data

Demand for Crypto - Blockchain Positions Skyrocketing

Indeed released a report on jobs in the blockchain and crypto market. The employment search engine says employer demand has skyrocketed, and the share of jobs per mission grew by 1,457% between September 2015 and the same period in 2019. Share of searches grew at the same time by 469%. Indeed identified the to 5 positions in this category as senor software engineer, senior software engineer, software architect, full stack developer and front end developer.

Exchange and Product News

Tether Calls New University of Texas Claims Defective and Clumsy

Tether has issued a response to the latest report from the University of Texas claiming a single trader manipulated the bitcoin market leading to the 2017 bull run. Tether calls the paper a “weakened yet equally flawed version of their prior article” which “still suffers from the same methodological defects, coupled with the clumsy assertion that one lone whale may be responsible for the rise of bitcoin in 2017.“ Citing a fundamental lack of understanding by the authors, Tether denies claims asserting its tokens were issued to enable illicit activity, but reiterates that all tokens are fully backed by reserves and issued pursuant to market demand.

Note: It should be noted that the loss in 1:1 reserves was reportedly caused by Bitfinex borrowing as much as $700 million from Tether not from the creation of fictitiously propped reserves.

Ripple Reporting Network Growth

Ripple has reported that it now has over 300 RippleNet customer across 45 counties, a 10x year-over-year improvement. In 2019 the amount of customers using the firms On-Demand Liquidity leveraging XRP as a bridge to eliminate the need for pre-funding in cross border payments has increased 7x.

Thoughts on the Ecosystem

Parallels Between Reformation and Bitcoin

In a just released research report Adamant Capital is comparing the emergence of bitcoin, encryption and the internet to a wave of similar dynamics in Europe in the 16th – 17th centuries. The Tuur Demeester led team argues that the historic actions of the Reformation led to the creation of innovative economic institutions that charged the world in the same manner digital currencies are unveiling the spark to ignite a new transformation and economic class.

Blockchain's Illusion of Traceability is Worrying

PwC Agribusiness Leader Craig Heraghty says that blockchain systems are proven in theory but still need to provide proof they can deliver on their promise of revolutionizing supply chain logistics. “The weakest link in the chain is not blockchain or any technology, the weakest link is the piece of sticky tape that puts the label on the package…You have to think like a fraudster and see where you can copy a label or a QR code,” he said. While Heraghty doesn’t really specify any particular blockchain solution as a problem, he does believe that “the illusion of traceability [provided by blockchain-powered systems] is a worrying trend”.

In order to unsubscribe, click here.

If you were forwarded this newsletter and you like it, you can subscribe here.

Created with Revue by Twitter.

BitDigest is a weekday news update on digital currencies and blockchain technology for friends and partners of Parsons & Whittemore, a single family office based in Rye Brook, New York. Receipt of BitDigest is by approval of the Author. The commentary, analysis, opinions and recommendations in this newsletter represent the personal and subjective views of the Author, and are subject to change at any time without notice. The information provided in this newsletter is obtained from sources which the Author believes to be reliable. However, the Author has not independently verified or otherwise investigated all such information. Neither the Author nor any of the Author's affiliates make any guarantee or other promise as to any results that may be obtained from reading this newsletter. While past performance may be analyzed in this newsletter, past performance should not be considered indicative of future performance. No reader should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. The Author is not making a solicitation or offer to buy or sell any securities of any kind.