BitDigest - Friday November 3, 2017

Over the past seven days, bitcoin (BTC) is up 27% with 24-hr trading volume exploding overnight exceeding $4.5 billion. The leading digital currency ended the week on a strong note up 4.9% to $7,400. Downside support is being demonstrated at $6,800.

Bitcoin Cash (BCH) continued a similar positive trend up 16.5% (24-hr) to $664 on volume of $2 billion. BCH has not reached these levels since its initial bull run in mid-August when it surpassed $825 per coin. BCH’s hash rate remains relatively low at 557 Phash/s so it appears that the positive momentum is being driven by speculators excited about the implications of BCH’s upcoming fork and not the mining community. However following the favorable difficulty adjustment, miners may jump back in.

Ethereum (ETH) is up 3.7% on volume of $785 million. Unfortunately, ETH continues to be unable to demonstrate its ability to breakaway from the $300 level for any period of time. (5:20AM EST)

* * * * * * * * * *

“What happens to my bitcoin if I die?” This is a question several people have posed so I want to provide a basic answer including a simple explanation of Bitcoin’s cryptographic keys.

Bitcoin’s cryptography requires the use of two keys: public and private. The public key is a 34 digit alpha-numeric number. It also referred to as an address as it identifies the sender and recipient in a bitcoin transaction. Since it is public it is meant to be shared. The address’ use of an alpha-numeric number is why many people incorrectly assume that bitcoin is anonymous. I like to make the comparison to a Swiss bank. The account addresses are also secretive but ownership can be traced through the bank (the on/off ramp) similar to bitcoin on an exchange.

The private key allows the transaction to be completed; it authorizes bitcoin to be spent and should be kept secret. Public knowledge of a private key will allow anyone to spend/transfer your bitcoin and as the Bitcoinblockchain is immutable, these transactions cannot be reversed. Technically speaking, a private key is actually an integer between one and about 10^77. If you were actually able to process one trillion private keys per second, it would take more than one million times the age of the universe to count them all. This vast keyspace plays a fundamental role in securing the Bitcoin network.

It is very important to remember that Bitcoin’s blockchain is decentralized or more importantly there is no central authority. Unlike with your email password, there is no link to reset your private key on the blockchain. As such, if you custody your own bitcoin, in the case of death, your heirs cannot approach the courts and, as beneficiaries under your estate, claim your bitcoin. If they do not have access to the private key, they will not have the ability to spend/transfer the bitcoin and the digital currency will be considered abandoned. One of the main reasons people use third party exchanges is to act as the custodian, i.e. Coinbase. If you forget your Coinbase password you can reset it, but many of us have read stories about people stealing bitcoin from exchanges; if you store your bitcoin securely offline in a cold, hard wallet it is unhackable.

Besides acting as the authorizing party to approve transactions, hard wallets store private keys so that the sender does not actually know their own private key. Hard wallets use a quasi-master password which is referred to as a “seed” and is initially used to generate your private and public key. A seed uses a 12-24 word pass phrase and allows you to restore your wallet if entered properly; these are randomly generated words like “focus”, “skeleton” and “fourteen”. You will need to know all 24 words in order to restore your wallet. (This process can also allow you to restore your wallet if it is damaged or lost). I personally keep my seed in a safety deposit boxes (it’s not at my home or office) with clearly written instructions on how to use them and access my bitcoin wallet in case of an emergency.

Although maintaining your own hard wallet is a learning process, it is the most secure way to store bitcoin so I strongly recommend it. I would also recommend storing the seed with written step-by-step instructions on how it can be used to restore your wallet in the unfortunate case of a lost or damaged wallet or worse death.

Curated News

Credit Suisse CEO Skeptical About Bitcoin 'Bubble'

Credit Suisse Chief Executive Tidjane Thiam expressed caution about Bitcoin, saying the current interest in the crypto-currency could eventually subside. “The only reason today to buy or sell bitcoin is to make money, which is the very definition of speculation and the very definition of a bubble,“ he said. Thiam also questions banks interest given the anonymous nature of digital currencies: "I think most banks in the current state of regulation have little or no appetite to get involved in a currency which has such anti-money laundering challenges.”

India’s Largest Bank Going Big on Blockchain

The State Bank of India (SBI) is gearing up to implement blockchain solutions in a number of financial processes including the management of its Know Your Customer (KYC) system. In February, SBI announced ‘Bankchain’, India’s first financial blockchain consortium comprising of India’s biggest banks (both public and private) alongside technology companies including IBM and Microsoft. The new KYC solution will boost the efficiency of financial institutions without comprising on data confidentiality and transaction security.

One of the Biggest Bitcoin Bulls on Wall Street Just Turned Cautious

Fundstrat Global Advisors head of research Thomas J. Lee, who previously called for bitcoin to hit $6,000 by the middle of 2018 and $25,000 by 2022, has turned cautious after the recent rally “on contemporaneous fundamentals.” Lee says the roughly 60 percent surge in the past month to more than $7,000 is a result of multiple factors, including the CME Group Inc.’s plan to offer futures and speculation Amazon.com Inc. is acquiring crypto-related domain names. He recommends buying bitcoin in the $5,500 range and the Bitcoin Investment Trust (GBTC) at $750, and is “long-term constructive” on bitcoin, maintaining his 2022 price target of $25,000.

GDAX Offerings to Expand but Exclude Majority of ICOs

Global Digital Asset Exchange (GDAX), Coinbase’s institutional trading platform, has the world’s fourth highest bitcoin trading volumes, but the ongoing increase in digital currency issuance has not swayed them to suddenly increase their trading pairs. Currently, GDAX support bitcoin, litecoin and ethereum. The company reports its primary request is adding more digital assets. In response, the exchange has launched a framework for evaluating digital assets for admission to its platform: whether the team developing the coin has a “track record of demonstrable success or experience”, if there are examples of “real-world implementation” for the coin, and whether it advances GDAX’s company goals of creating an “open financial system”. GDAX will add a handful of new coins next year.

Are Bitcoin Futures Repeating History from Tulip Bubble?

UBS economist Paul Donovan reports that plans for bitcoin futures contract mirror the situation just before the tulip bubble burst in the 1600s. In 1636, cash-settled futures were introduced in the tulip market. Prior to this physical product had to be delivered, but cash-settled futures contracts allowed cash to be delivered upon expiration. Donovan, thinks: “We’ve been here before.”

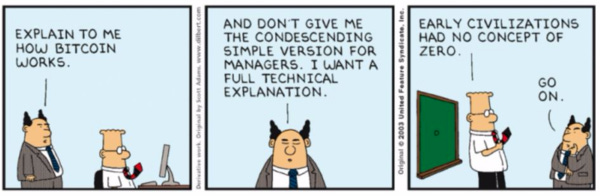

Cartoon of the Day

In order to unsubscribe, click here.

If you were forwarded this newsletter and you like it, you can subscribe here.

Created with Revue by Twitter.

BitDigest is a weekday news update on digital currencies and blockchain technology for friends and partners of Parsons & Whittemore, a single family office based in Rye Brook, New York. Receipt of BitDigest is by approval of the Author. The commentary, analysis, opinions and recommendations in this newsletter represent the personal and subjective views of the Author, and are subject to change at any time without notice. The information provided in this newsletter is obtained from sources which the Author believes to be reliable. However, the Author has not independently verified or otherwise investigated all such information. Neither the Author nor any of the Author's affiliates make any guarantee or other promise as to any results that may be obtained from reading this newsletter. While past performance may be analyzed in this newsletter, past performance should not be considered indicative of future performance. No reader should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. The Author is not making a solicitation or offer to buy or sell any securities of any kind.