BitDigest - Friday May 7, 2021

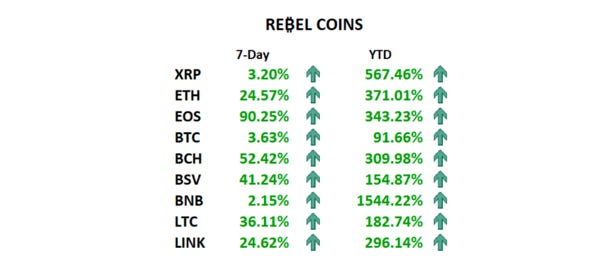

Crypto prices post strong weekly returns but weaken on Gensler comments

SEC Chairman calls for greater regulatory oversight for crypto markets

Square doubles traditional revenue with bitcoin sales in first quarter

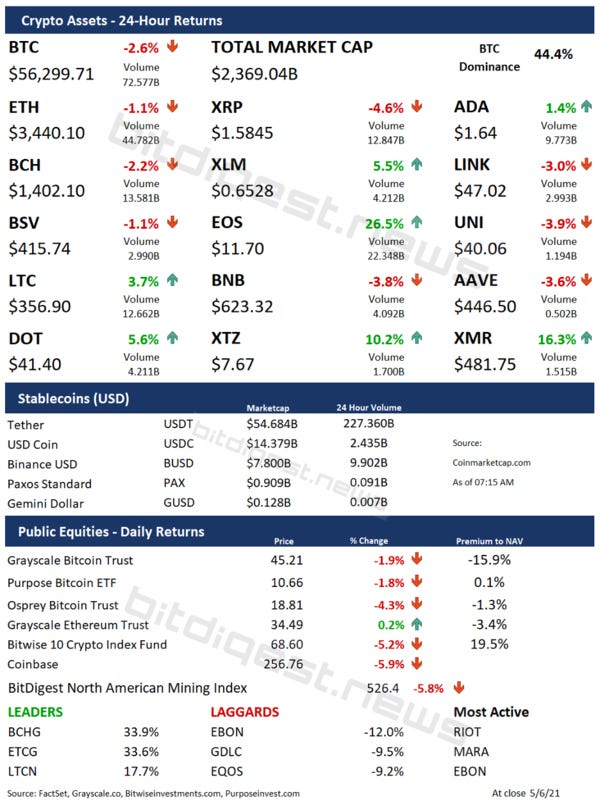

Two quick highlights on public crypto proxies:

The premium to NAV on the Bitwise 10 Crypto Index Fund (OTCQX: BITQ) has been weakening and dropped below 20% for the first time

The Grayscale Ethereum Classic Trust has increased 200% over the past 5 trading sessions

Live, From New York…

Just a reminder that on Saturday, the self-proclaimed ‘Dogefather,’ Elon Musk is hosting Saturday Night Live. I have to assume that cryptocurrencies will play a major theme in his monologue and skits.

The Headlines

Crypto-Soft Gensler Shows Tough Side

SEC Chairman Gary Gensler told the House Financial Service Committee that the crypto market could benefit from oversight and “greater investor protection” calling Congress to appoint a specific regulator over the crypto industry.

Iran Bans Trading of Foreign-Mined Bitcoin

The Central Bank of Iran has prohibited the trading of digital currencies mined outside of the country signaling a possible approach allowing the government to use digital currencies to fund sanctioned imports.

Mining Costs Can be Expensed Under South Korean Regulations

South Korea’s Ministry of Economy and Finance said that while virtual currency transactions will begin to be tax at a 20% rate starting next year, any expense associated with mining digital currencies can be deductible.

Central Bank Agency Not Willing to Make Crypto Decision on Behalf of Banks

The Central Bank controlled National Payment Corporation of India is refusing to ban crypto trading and has told domestic banks to make this decision themselves.

Cryptocurrencies Have 'No Intrinsic Value'

Bank of England Governor Andrew Bailey reiterated his negative views on digital currencies saying “they have no intrinsic value” and warning investor looking to invest in crypto assets that they risk losing all of their money.

Fed Lists Crypto and Stablecoins as Potential Shock to Financial Markets

The Federal Reserve’s updated Financial Stability Report has identified cryptocurrencies and stablecoins as ‘salient shock’ to the stability of financial markets but identified them as #9 out of the top 14 potential shocks over the next 12 to 18 months. “Vaccine-resistant varients” become the number one potential shock replacing “US political uncertainty,” the top concern on the previous November survey.

SQ Increases Revenue by 2.2x Due to Bitcoin Sales

📈Square (NYSE: SQ) reported $3.5 billion in revenue attributable to bitcoin generating $75 million in profit, (2% of bitcoin revenue) during the payment platform’s first quarter earnings release.

Bit Digital Reports 141% Increase in Mining Revenue

📈Bit Digital (NASDAQ: BTBT) reported $43.9 million in Q1 revenue from crypto mining with $35.7 million in net income.

Bitfarms Adding 6,600 Bitmain Pro Miners

📈Bitfarms (TSXV:BITF) announced the purchase of 6,600 new Bitmain miners adding 660 Phash/s to the Canadian miner bringing them – once installed – to 83% of their objective of having 3 Ehash/s of operations by the end of the 2021.

COIN Announces Shareholder Q&A Platform

📈In its continued effort to be transparent to all investors, Coinbase (NASDAQ: COIN) has launched a Q&A platform allowing all shareholders to submit and upvote questions to management ahead of its May 13th quarters earnings call.

MILE to Allow Payment of Premiums and Claims in BTC

📈Digital car insurance company Metromile (NASDAQ: MILE) announced plans to allow policy holders to pay for insurance and receive payment of claims in bitcoin. In addition, MILE is purchasing $10 million in BTC as a treasury holding.

Goldman Offering Crypto Products

📈Goldman Sachs (NYSE: GS) has started offering non-deliverable bitcoin forwards to select customers and may next offer hedge fund clients exchange-traded notes based on bitcoin or access to the Grayscale Bitcoin Trust (OTCQX: GBTC).

VanEck Launches Digital Assets Equity ETF

📈VanEck has launched the VanEck Vectors Digital Assets Equity UCITS ETF , Europe’s first thematic ETF that offers exposure to companies involved in the cryptocurrency and blockchain industries

Citi Considering Crypto Offering

📈Citi’s (NYS: C) global head of foreign exchange says the bank is “considering” how to best serve its clients with crypto offerings and will not be setting up a “prop-trading effort.”

ETA Issues Guiding Principles for CBDCs

📝The Electronic Transactions Association (ETA) publish a list of 7 principles, the leading trade association for the payments industry believes all central bank digital currencies should be measured against.

Crypto.com Becomes Official Cryptocurrency & NFT Sponsor of the 2021 Coppa Italia

Digital exchange Crypto.com has partnered with Italy’s professional soccer league (Lega Serie A) to become the ‘Official Cryptocurrency & NFT Sponsor of the 2021 Coppa Italia.’ Crypto.com will release a collection of NFTs to commemorate the historic final.

Exchange, Custody and Product News

🐦FTX has taken its next step away from its historic crypto focus launching lumber futures on its digital platform.

Daily Cartoon

In order to unsubscribe, click here.

If you were forwarded this newsletter and you like it, you can subscribe here.

Created with Revue by Twitter.

BitDigest is a weekday news update on digital currencies and blockchain technology for friends and partners of Parsons & Whittemore, a single family office based in Rye Brook, New York. Receipt of BitDigest is by approval of the Author. The commentary, analysis, opinions and recommendations in this newsletter represent the personal and subjective views of the Author, and are subject to change at any time without notice. The information provided in this newsletter is obtained from sources which the Author believes to be reliable. However, the Author has not independently verified or otherwise investigated all such information. Neither the Author nor any of the Author's affiliates make any guarantee or other promise as to any results that may be obtained from reading this newsletter. While past performance may be analyzed in this newsletter, past performance should not be considered indicative of future performance. No reader should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. The Author is not making a solicitation or offer to buy or sell any securities of any kind.