BitDigest - Friday March 8. 2019

Day 2 Highlights from DC Blockchain Summit

Rep. Tom Emmer (R-MN), Co-Chair, Congressional Blockchain Caucus suggested that many of his colleagues are overlooking the “revolutionary aspect” of cryptocurrencies and just focusing on blockchain. He believes the real innovation within the ecosystem has been the ability to develop an open network without a gatekeeper / middle man. He added open network are not simply limited to securities and commodities. Emmer believes the technology follows the US ideals of liberty through individual empowerment. He warned that a light touch regulatory approach will allow the industry to define key innovations and suggested that we are currently operating under a regulation by enforcement regime. If Congress over regulates “who will lead if we do not,” he asked.

“People who entered the blockchain space as a cash grab have been weeded out”

“Regulatory arbitrage is allowing start-ups to leave the US in search for money”

A panel on voting identified three legs to the voting stool: the usability of the blockchain platform, verification of the individual, and verification and functionality of the technical component

“Need to celebrate the mechanics underneath the technology to express value… Difficult to value what is unknown and far in duration”

Fidelity’s crypto currency offering is live; the company admitted it began production earlier this year without a formal announcement. As part of their crypto education they commissioned a study of 400 institutional investors, pensions and family office. The study revealed that 22% of respondents already have a allocation to crypto; there is a direct correlation between an allocation or desire to invest with the respondents understanding of the technology; and, current investors expect to double their allocation over the next five years. The survey revealed the reason investors have not participated in the asset class is because of continuing market volatility, regulatory uncertainty and the limited history (track record) of digital currencies which hinders the investors ability to complete their own analysis.

Stephen Pair, CEO, BitPay, expects most databases will become blockchain style databases in the future (transparent and secure – immutable through its use of cryptography).

Cisco’s Al Lynn, retired Lieutenant General and former Director of the United States Defense Information System, shred that the Defense Department’s 3.4 million user network receives 1 billion hack attempts every day. His real interest in blockchain is tied to sovereignty of identity. He believes verification of identity can drive accountability. Unlike current 2 factor authentication processes (2FA) Lynn said he had been reviewing 7 factor identity authentication schemes for trust and mobile communication while at the Department of Defense.

Erik Bethel, Executive Director, The World Bank identified different blockchain initiatives that can help global development: creating a market place for natural resources; helping build an economy for the unbanked; decentralizing governance and accountability; and bringing transparent to supply chains and movement of goods and services.

The Headline

South Korea Establishes Crypto Crimes Task Force

In a response to the growing number of crypto crimes, South Korea’s Supreme Prosecutors’ Office has established a task force to fight cryptocurrency-related fraud. The new enforcement team will be responsible for the investigation of fraud, illegal money laundering, crimes and other illegal activities within the fields of fintech and digital assets.

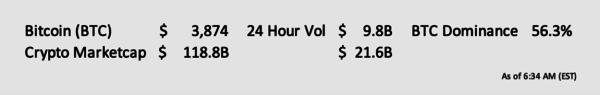

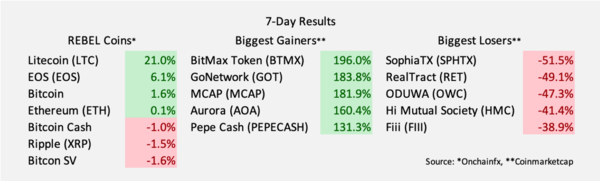

Market Data

FCA Releases UK Survey on Crypto Ownership

The Financial Conduct Authority (FCA) believes on 3% of UK residents have purchased digital currencies. The UK financial watch dog released a new consumer survey report titled “Cryptoassets: Ownership and attitudes in the UK” and found 70% of the 2,000+ respondents had not even heard of cryptocurrencies or couldn’t name one. The survey showed that UK residents were taking a more conservative approach to buying the assets, using their own money – none of the respondents reported borrowing money from financial firms or friends/family – and approximately 40% of cryptocurrency owners expect to ‘hodl’ for 3 or more years.

oemmndcbldboiebfnladdacbdfmadadm

Exchange and Product News

New Samsung Galaxy S10 Does Not Support Bitcoin

Samsung’s soon to be released Galaxy S10 has a built-in cryptocurrency wallet, but details have been revealed that as delivered the phone will initially only offer support for ether (ETH). No further details have been provided so for now bitcoin fans will not be able to store their coins on it. It is rumored that the wallet was developed by Enjin.

EToro Bringing Crypto Trading to US

eToro plans to launch its platform in the US. The social investing and trading platform will start by limiting its offering to crypto assets but expects to add support for additional asset classes over the next 12 months. eToro plans to enter the market supporting bitcoin, ether, litecoin, bitcoin cash, and ripple.

Thoughts on the Ecosystem

Roubini Calls Bitcoin Investors 'Arrogant' and 'Clueless'

Dr. Doom has more thoughts on bitcoin. Economist Nouriel Roubini, said bitcoin is an “exponential, parabolic bubble,” calling bitcoin investors “arrogant, ignorant, clueless” zealots and fanatics. “I’ve never seen in my life people who on one side are so arrogant in their views — who are total zealots and fanatics about this new asset class — while at the same time completely and totally ignorant of basic economics, finance, money, banking, central banking, and monetary policy.”

"Bitcoin is 'Extremely Resilient'

Andreas Antonopoulos feels that “bitcoin is the fifth evolution of money in its most abstract form coupled to a new governance model t hat delivers the the purest form of network governance we’ve ever seen.” The author of Mastering Bitcoin thinks the coin is making tremendous progress and has proven itself to be “enormously resilient.” Bitcoin has “been attacked both from the outside and the inside a number of times by different power structures and embedded interests both within and without the crypto space and it’s managed to repel these attacks and maintain the fundamental structure,” he explained.

JPM Coin will not Affect Bitcoin or XRP

CNBC’s Brian Kelly believes the addition of JPM Coin is a “a great signal because you have Jamie Dimon, icon of banking, who did not like bitcoin … now dipping his toe in [the ecosystem].” He stresses JPM Coin is completely different than bitcoin or ripple (XRP) and because it is currently only meant as an internal unit of account on JP Morgan’s ledgers, it should not displace the currencies which can be used by others.

In order to unsubscribe, click here.

If you were forwarded this newsletter and you like it, you can subscribe here.

Created with Revue by Twitter.

BitDigest is a weekday news update on digital currencies and blockchain technology for friends and partners of Parsons & Whittemore, a single family office based in Rye Brook, New York. Receipt of BitDigest is by approval of the Author. The commentary, analysis, opinions and recommendations in this newsletter represent the personal and subjective views of the Author, and are subject to change at any time without notice. The information provided in this newsletter is obtained from sources which the Author believes to be reliable. However, the Author has not independently verified or otherwise investigated all such information. Neither the Author nor any of the Author's affiliates make any guarantee or other promise as to any results that may be obtained from reading this newsletter. While past performance may be analyzed in this newsletter, past performance should not be considered indicative of future performance. No reader should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. The Author is not making a solicitation or offer to buy or sell any securities of any kind.