BitDigest - Friday June 7, 2019

The Headlines

SEC Not Willing to Just Flip Switch Approving Crypto

SEC Chairman Jay Clayton said that regulators are engaging on “cryptocurrencies” not tokens, but they are not reading to “flip a switch” and approve them like “stocks of bonds”. The SEC still needs to become comfortable with issues like custody and market surveillance. Clayton said that “custody is a long-standing requirement in our markets” and added that crypto markets still need “rules and surveillance to ensure that people are not manipulating” its marketplace.

Congressman Cites Importance of Blockchain

Congressperson Ted Budd (R-NC) called the development and protection of the domestic blockchain industry an issue of national security and is reissuing two crypto-friendly bills. He plans to reintroduce the Cryptocurrency Tax Fairness Act which will “extend the de minimis exemption for personal transactions in foreign currency to cover [cryptocurrency] transactions and Blockchain tokens.” He is also updating the Virtual Value Tax Fix which he hopes will ensure that digital assets are recognized as property eligible for the like-kind exchange tax deferral under Section 10(31) of the Income-Tax Act.

Facebook to Release White Paper on June 18th

Facebook’s Head of Financial Services & Payment Partnerships for Northern Europe has revealed new information about the social media giant’s plans for its cryptocurrency coin release. Laura McCracken said that a white paper will be released explaining the cryptocurrency basics on June 18th and that the token would be pegged to a basket of currencies rather than a single one, i.e. the US dollar, to prevent price fluctuations. The token is expected to be usable on Facebook products including Messenger and WhatsApp and will charge zero fees. Facebook is also working with merchants to accept the token as payment, and may offer sign-up bonuses.

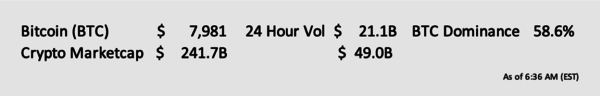

Market Data

Crypto Market Volatility Declining

Digital exchange SFOX has released its latest Crypto Market Volatility Report and found that BTC had a nearly perfect negative correlation with the S&P 500, highlighting public interest in BTC as a hedge against global markets. The report has a declining market index bring their outlook based on sentiment, price momentum and an advancement of the sector to “uncertain.” They also suggested that “Individual exchange gaffes underscored the need” for the entire market to mature.

Exchange and Product News

Batched Transactions Coming to Coinbase

Coinbase CEO Brian Armstrong responded to the repeated attack that his company clogs the bitcoin mempool by tweeting that Coinbase plans to begin batching transactions “in a few months.” Armstrong apologized for this delay by staying, “embarrassing how long it has taken, turns out there is a lot of stuff to build in a growing company :)”

Thoughts on the Ecosystem

Blockchain Brings New Vulnerabilities to Security

Stuart Madnick, a profession at MIT and the Founding Director of the Cybersecurity at MIT Sloan (CAMS) research consortium, is warning that blockchain technology “may be its worst enemy, as many of the things that make it so great also increase its vulnerability when it comes to security.” In a soon to be released study, Madnick’s team studied 72 cases of publicly reported blockchain system security breaches that occurred between 2011 and 2018. They found that blockchain adds new advances in encryption and security but that it also creates new vulnerabilities; examples of this are transparency, distributed control and anonymity.

IEOs are “Unregulated Crypto-Casino Fundraising Mutations”

John Reed Stark, the former SEC Chief of the Office of Internet Enforcement says that the US financial watchdog will soon be stepping in to stop what he calls “unregulated crypto-casino fundraising mutations.” Calling IEOs “an enticing medium for fraud, manipulation, insider trading, hacking and a broad range of chicanery” he accused the new funding methodology of being “another blatant attempt to hijack a similar-sounding acronym — IPO — in an effort to lure investors seeking to get rich quick.” Stark also said the he believes bitcoin investors will one day realize the value of their holding is zero.

Bankers Looking to Suffocate Bitcoin

Financial host Max Keiser says banks can no longer successfully respond to the growth in bitcoin. Keiser tweeted, “Banksters know now they can’t stop #Bitcoin. What they’ll try is a bear hug. They’ll try to crowd BTC out of the market by flooding the globe with their centralized crypto. The idea is to try and marginalize BTC. Fortunately, their own corruption will kill them.”

In order to unsubscribe, click here.

If you were forwarded this newsletter and you like it, you can subscribe here.

Created with Revue by Twitter.

BitDigest is a weekday news update on digital currencies and blockchain technology for friends and partners of Parsons & Whittemore, a single family office based in Rye Brook, New York. Receipt of BitDigest is by approval of the Author. The commentary, analysis, opinions and recommendations in this newsletter represent the personal and subjective views of the Author, and are subject to change at any time without notice. The information provided in this newsletter is obtained from sources which the Author believes to be reliable. However, the Author has not independently verified or otherwise investigated all such information. Neither the Author nor any of the Author's affiliates make any guarantee or other promise as to any results that may be obtained from reading this newsletter. While past performance may be analyzed in this newsletter, past performance should not be considered indicative of future performance. No reader should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. The Author is not making a solicitation or offer to buy or sell any securities of any kind.