BitDigest - Friday June 1, 2018

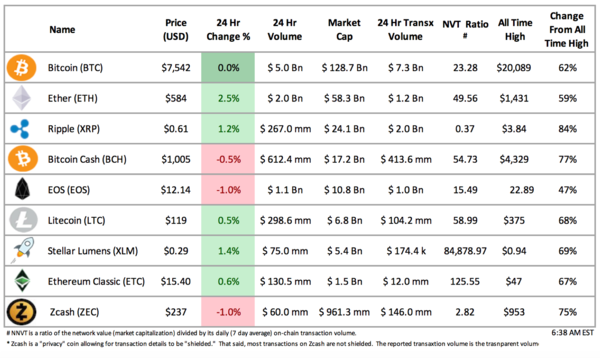

The REBEL coins are flat again today and most coins are showing a small increase in 24-hour trading volume. Only litecoin (LTC) and EOS (EOS) traded less this period. The total market cap of digital currencies is at $314 billion and bitcoin (BTC) dominance has slide just bellow 41%.

BTC futures volume is down 25% overnight with only $5,450 individually weighted equivalent bitcoin contracts transacting. June CME pricing is basically unchanged at $7,535 and September contracts inched up on the session to $7,660, up 0.8%.

* * * * * * * * * *

Kathryn Haun believes that cryptocurrencies and blockchain will not see regulation for years. The former federal prosecutor who led investigations into the Mt. Gox hack and the corrupt agents on the Silk Road task force, argues that there cannot be any regulation in the crypto field until regulators gain a solid understanding of how it works. Haun stressed the need to “wait and see how the technology develops,” adding that regulation should not “outpace understanding.” She also pointed out that in this fast moving space, waiting has benefits. She suggested that if regulation had been developed a couple years ago, it would have been outdated to respond to the the rise of new innovations like initial coin offerings.

* * * * * * * * * *

Mary Meeker’s annual Internet Trends report for 2018 suggests that interest in digital currencies is rising (slide 20). The report also highlights the interest that bitcoin and cryptocurrency technology courses are gaining (slide 233).

* * * * * * * * * *

I continue to suggest that cryptocurrency need their own “AOL disk,” an innovation that makes using digital currencies easy for the masses. One step in the right direction would be the creation of ‘human readable addresses.’ In a Forbes article, Isabella Dell, Founder and CTO of IOV (Internet of Value) suggests that “ blockchain platforms have failed to solve the user experience problem around wallet addresses” and recommends using a readable address like an email address instead of a string of 34 numbers and letters. Dell’s company is developing a decentralized blockchain address registry.

* * * * * * * * * *

Bittrex, a leading US digital currency exchange has announced, it will add USD trading pairs to its platform. The Washington state based exchange is reported to have signed a banking agreement with New York-based financial institution Signature Bank that will allow it to begin accepting USD deposits and listing cryptocurrencies for trading directly against the dollar. It is believed activity at the exchange which trades daily volume of $100 million will increase as the platform becomes one of a small handful to support fiat-to-crypto trading; most fiat to crypto USD trading platforms focus on the REBEL coins and do not offer the 200 alt-coins Bittrex does.

Curated News

Estonia Scales Down Plan to Create National Cryptocurrency

Estonia has scaled down its plan to create a national cryptocurrency after it drew criticism from Mario Draghi and local banking authorities. The Baltic country dropped plans to peg these digital tokens to the euro or offer them to all citizens, an official in charge of the country’s IT strategy said. Instead, they will be given as an incentive to e-residents, foreigners who use Estonia’s electronic identification to remotely sign documents and set up companies, he said. Draghi criticized the so-called Estcoin proposal in September, saying the euro can be the only currency in the country of 1.3 million. His stance was echoed by central bank Governor Ardo Hansson, who lamented over “misleading reports” on Estcoin from government agencies.

Hong Kong: ‘No Plan’ for Central Bank Digital Currency Now

Despite carrying out research on a central bank digital currency (CBDC), the Hong Kong Monetary Authority (HKMA) is unlikely to issue a currency any time soon. A senior government official from Hong Kong has ruled out plans for CBDC presently, claiming the country already has an efficient payments infrastructure. Acting secretary for financial services and the treasury Joseph Chan explained that “In the context of Hong Kong, the already efficient payment infrastructure and services make CBDC a less attractive proposition. The HKMA has no plan to issue CBDC at this stage but will continue to monitor the international development.”

Central Banks Need to Compete With Crypto

A deputy director for the International Monetary Fund’s Monetary and Capital Markets Department believes that central banks need to offer “better” fiat currencies in order to fend off any potential competition from cryptocurrencies. In an article titled “Monetary Policy in the Digital Age: Crypto assets may one day reduce demand for central bank money,“ Deputy director Dong He argues that central banks may want to consider adopting some cryptocurrency concepts in order to “forestall the competitive pressure crypto assets may exert on fiat currencies.” He suggests government authorities should regulate the use of crypto assets to prevent regulatory arbitrage and any unfair competitive advantage crypto assets may derive from lighter regulation.“

India Won’t Pay for Venezuelan Oil With ‘Petro’ Cryptocurrency

Despite being offered a reported 30% discount in crude oil imports from Venezuela for payment in petro, India has no plans to use the South American nation’s cryptocurrency after being hindered by its central bank crypto curbs. Indian foreign minister Sushma Swaraj said the country has no plans to use the petro in purchasing oil, citing an order from India’s central bank which does not permit trade using cryptocurrency: “We cannot have any trade in cryptocurrency as it is banned by the Reserve Bank of India. We will see which medium we can use for trade.” Swaraj added that this decision is not due to the US led-financial blockage again Venezuela, “India follows only UN sanctions, and not unilateral sanctions by any country,” Swaraj said.

Court Orders Chilean Banks to Reopen Cryptocurrency Exchange Accounts

Chile’s anti-monopoly court has ordered Chile’s three major banks, including Bancoestado, Chile’s only public bank, to reopen accounts for digital currency exchanges. Local exchanges have been fighting with the banks since they decided to close their accounts; the exchanges suggest the banks maintain too much control. An appeal to the precautionary measure confirmed by Chile’s Tribunal for the Defense of Free Competition is expected.

Venezuela Confiscating Imported Bitcoin Mining Rigs

As Venezuelan’s face a financial crisis and turn to bitcoin, the Venezuelan government has started confiscating shipments related to cryptocurrency mining. Courier services have recently begun informing clients about this measure. As such, users are advised not to order any bitcoin mining hardware outside of Venezuela, although acquiring it inside the country is early impossible. With government subsidized electricity, mining has been gaining popularity among the locals, but now the government is targeting mining for legal repercussions. That is unless locals start to support the petro.

Warning to Shorts, Bitcoin May Have Found Its Bottom

Robert Sluymer, head of technical strategy at Fundstrat Global Advisors believes bitcoin may have found its bottom. “When we step back, we see the first phase starting to happen. We think Bitcoin is starting to bottom off some very key support around $7,000 and we think it’s going to start a recovery process here,” he said. Momentum also looks positive to Sluymer, indicating a decline in Bitcoin may have found a floor. “The next thing that has to happen is to see Bitcoin actually rally through the downtrend and we use the 15-day moving average, it’s very simplistic, but it’s a pretty good proxy across most markets,” said Sluymer. Its 15-day moving average of roughly $7,800 “will be the next hurdle for it to get through.”

If Bitcoin is a Bubble The Panic Stage is Near

Joost van der Burgt, a policy adviser at the Federal Reserve Bank of San Francisco, said that if it is indeed a bubble, it’s likely at the beginning of the profit-taking stage, which means panic might be around the corner. He believes the market is entering the profit-taking stage, a phase where so-called smart money begins to head for the exits, leaving only one step left before the bubble pops. “The subsequent ‘panic’ phase, should it come to that, commences when reality sets in and bitcoin’s price would substantially crash,” wrote van der Burgt. However, this argument comes with a caveat. “Then again, maybe bitcoin is different than anything we have seen before, and maybe a decade from now its market capitalization will be sky-high as it attains the status of a new global currency,” van der Burgt said.

Buy Bitcoin While It's Still Cheap

Dan Morehead, founder of Pantera Capital Management believes now is a good time to buy bitcoin. “All cryptocurrencies are very cheap right now,” he says adding that “it’s much cheaper to buy now and participate in the rally as it goes.” Morehead feels there is still an opening in the market, “many institutions are essentially buying the rumor [of potential SEC regulations] and selling the fact,” he said. He suggests that one invest “now so that in three, four, five months when the institutional, quality-regulated custodians that we’re hearing about come online, [the investors will] already have their positions.“

Fact of the Day

Over 9 years, $1 trillion in entries were added to the bitcoin blockchain and 0 were fraudulent. This compares to 3% of fraudulent transactions that occur annually across the US economy.

Source: Tom Lee, Fundstrat

In order to unsubscribe, click here.

If you were forwarded this newsletter and you like it, you can subscribe here.

Created with Revue by Twitter.

BitDigest is a weekday news update on digital currencies and blockchain technology for friends and partners of Parsons & Whittemore, a single family office based in Rye Brook, New York. Receipt of BitDigest is by approval of the Author. The commentary, analysis, opinions and recommendations in this newsletter represent the personal and subjective views of the Author, and are subject to change at any time without notice. The information provided in this newsletter is obtained from sources which the Author believes to be reliable. However, the Author has not independently verified or otherwise investigated all such information. Neither the Author nor any of the Author's affiliates make any guarantee or other promise as to any results that may be obtained from reading this newsletter. While past performance may be analyzed in this newsletter, past performance should not be considered indicative of future performance. No reader should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. The Author is not making a solicitation or offer to buy or sell any securities of any kind.