BitDigest - Friday August 17, 2018

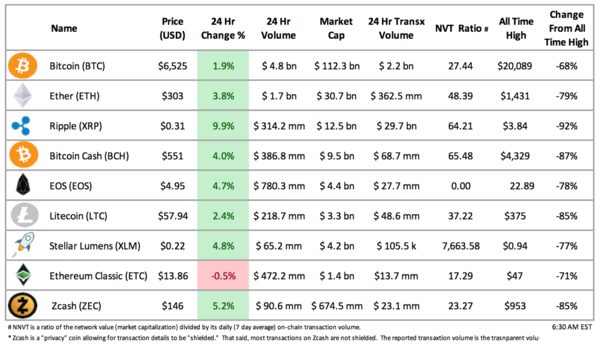

Its been a crazy few days for bitcoin (BTC) but at the end of the week, BTC is reporting a 2% increase. If you took the passive approach and “hodl’d,” your return over the past year would be a respectable 41% increase. The real story has been the recent decline in ether (ETH). Although ETH has recovered and is trading back above the $300 level, ETH is down 15% for the week and basically flat, up 2%, for the year.

The crypto marketcap is back above $200 billion and with ETH’s increase, BTC’s dominate has slipped below 55%.

BTC future volumes grew 6% overnight, with 16,580 individually weighted BTC trading. Future pricing is flat this morning; August CME contracts are holding at $6,415 and December at $6,485.

* * * * * * * * * *

Mining operations is the Norwegian cities of Follum, Honefuss, and Dale have received the bomb threats. The anonymous warning said “this is sabotage. If you are expanding crypto mining and filling the country with noise, then you will be sabotaging the peace. I am threatening to send you some explosives”. Norwegian police are looking into the matter and assessing whether further action should be taken.

* * * * * * * * * *

In what seems to be a daily update on Coinbase, the US exchange has announced its is rebranding its ‘Toshi’ app wallet to ‘Coinbase Wallet.’ The company said this is not “just a new name, but part of a larger effort to invest in products that will define the future of the decentralized web and make that future accessible to anyone.” It is their hope that this wallet will become a common “gateway to the open financial system.” To learn more about Coinbase Wallet or download the app, visit wallet.coinbase.com.

* * * * * * * * * *

The decline in the price of bitcoin has impacted rewards earned by miners. Genesis Mining, a cloud based miner with over 2 million clients, is changing its basic plan and asking users to upgrade with a ‘premium discount.’ The company announced that its lower level contracts are no longer generating enough mining rewards to cover their daily maintenance fees and therefore entering a 60-day grace period after which the open-ended contracts will be terminated. Under the new plan, the daily maintenance fee is $0.14 per THash/day.

* * * * * * * * * *

The US Senate will be discussing the crypto-sphere again next week. The Committee on Energy and Natural Resources is hosting a hearing on “Energy Efficiency of Blockchain and Similar Technologies” on August 21st at 10AM to review the technologies impact on electricity prices and determine whether or not benefits are provided especially in the area of cybersecurity. It appears that a live webcast will be available.

* * * * * * * * * *

An English translation of Bitmain’s IPO Investor Deck has been posted the internet. Translated by @cruptoriceball the presentation provides an industry and technology overview, company profile and customary investment highlights and business risks. One of the surprising risks is the declaration that Bitmain does not pay any tax; the company has a self-declared “0 tolerance to any tax risks.” Given the public exposure this IPO is brining, I cannot imagine this will continue.

Curated News

Bank of China Partners With China UnionPay to Explore Blockchain for Payment Systems

The commercial, state-backed Bank of China (BOC) and financial services corporation China UnionPay (CUP) have entered into a partnership to explore blockchain applications for payment system development. The BOC and CUP plan to jointly investigate big data and distributed ledger technology deployment in order to improve mobile banking products. The CUP aims to build a unified port for mobile integrated financial services, where cardholders will be able to use a QR code to spend, transfer and trade on a cloud flash payment app.

ASX Increasing Blockchain Spending to Gain Global Position

The Australian Securities Exchange (ASX) has established a plan to become a best-in-world trading services platform using a combination of distributed ledger, advanced analytics and artificial intelligence capabilities to attract new listings and participants. Dominic Stevens, the ASC’s MD and chief executive said that technology infrastructure spending to support this will be increasing from $54.1 million this year to over $70 million in 2019. He said wants to bring the ASX to the world stage, beyond, the “A$ and NZ$ markets” and embark “on a world-leading upgrade of our post-trade systems using [blockchain technology.]”

Thailand Approves Digital Exchanges and Places Asset Class Under Legal Framework

Seven cryptocurrency businesses were approved by Thai regulators to legally conduct digital asset operations as part of the country’s shift toward optimizing the local blockchain, ICO and cryptocurrency ecosystem. Following a royal decree that unveiled a series of “transitional” rules for crypto companies, businesses were allowed a 90-day grace period to service customers while awaiting their application results. With this first approval, regulators have classified cryptocurrencies as “digital assets and digital tokens,” and formally brings the asset class under the Thai legal framework.

Nvidia Forecast Lags Wall Street as Crypto Demand Weakens

Nvidia Corp says cryptocurrency-fueled demand has dried up and delivered sales well below Wall Street expectations. The company’s bleak outlook for cryptocurrency chips was a sharp reversal from the prior fiscal quarter, when sales to crypto miners reached 10% of the company’s revenues. Nvidia missed on its own Q2 forecast by 82%, total revenue from crypto miners only reached $18 million.

Binance LCX Announces Fiat-to-Crypto Exchange

Binance LCX, a joint venture between Binance and LCX, a Licechtenstein crypto asset exchange, announced the launch of a fiat-to-crypto exchange in LCX’s home country. In what sound like a white-label offering, Binance will provide and maintain the technology platform, while Binance LCX manages customer support, legal requirements, due diligence, KYC, AML and government communication.

UEFA Super Cup Tickets Distributed Via Blockchain

UEFA, the governing body of European football, has successfully deployed a new ticketing system, which is looking to improve the ticket distribution system by preventing the replication and duplication of tickets. 100% of the tickets for this week’s Super Cup match between Real Madrid and Atlético de Madrid were sold and distributed using a blockchain based iOS and android app.

Cartoon of the Day

In order to unsubscribe, click here.

If you were forwarded this newsletter and you like it, you can subscribe here.

Created with Revue by Twitter.

BitDigest is a weekday news update on digital currencies and blockchain technology for friends and partners of Parsons & Whittemore, a single family office based in Rye Brook, New York. Receipt of BitDigest is by approval of the Author. The commentary, analysis, opinions and recommendations in this newsletter represent the personal and subjective views of the Author, and are subject to change at any time without notice. The information provided in this newsletter is obtained from sources which the Author believes to be reliable. However, the Author has not independently verified or otherwise investigated all such information. Neither the Author nor any of the Author's affiliates make any guarantee or other promise as to any results that may be obtained from reading this newsletter. While past performance may be analyzed in this newsletter, past performance should not be considered indicative of future performance. No reader should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. The Author is not making a solicitation or offer to buy or sell any securities of any kind.