BitDigest - Friday April 16, 2021

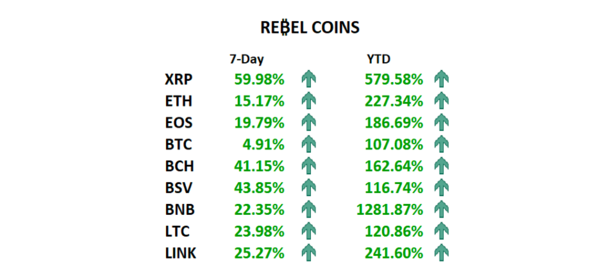

Crypto prices end week on significant high with median 7-day return on Rebel Coins at 24%

Turkey bans the use of crypto to purchase goods and services

Grayscale invests in ETF provider who subsequently changes name of existing ETF to “BTC”

Coinbase (NASDAQ: COIN) has been added to the daily update of public equities

The Headlines

President Accuses Russia of Using Crypto to Interfere with US Elections

President Biden’s Executive Order on Russia’s interference in the US elections accuses Russia of participating in “deceptive or structured transactions or dealings to circumvent any United States sanctions, including through the use of digital currencies or assets or the use of physical assets.”

In response the Department of Treasury Office of Foreign Assets Control (OFAC) blacklisted specific digital currency addresses used to receive over $2.5 million in funding and launder profits.

The Central Bank of Turkey has banned the use of cryptocurrencies and crypto assets to purchase goods and services, citing possible “irreparable” damage and significant transaction risks adding crypto assets are “neither subject to any regulation and supervision mechanisms nor a central regulatory authority.”

Chinese Mining Pools Impacted by Planned Power-loss

The hashrate of bitcoin mining pools experienced a sudden 24-hour decline in production as the Northwest Chinese region of Xinjiang, experienced a comprehensive power outage for safety reasons; Xinjiang reportedly represents 36% of China’s combined hashing power and 23.3% of the world’s hash rate.

Crypto Task Force Proposed for Miami-Dade County

A resolution has been submitted to Miami-Dade County proposing a Cryptocurrency Task Force be formed to study the feasibility of accepting cryptocurrency and other digital monetary forms as an acceptable method of payment for taxes, fees, and services, and provide recommendations to the Board on other policy initiatives relating to cryptocurrencies that would be advantageous to the County.

Chinese Money Supporting Iran's Largest Bitcoin Miner

Chinese investors appear to have provided capital to assist Iran’s largest bitcoin mining facility resume operations after the facility in the southeast Kerman province was closed following local demonstrations prompted by local blackouts.

Grayscale Invests in "BTC" ETF Provider

📈In a surprise and potentially meaningful investment, Grayscale Investments has purchased an ownership interest in ClearShares, an ETF provider, with Clearshares simultaneously announcing that it was changing the ticker for its Piton Intermediate Fixed Income ETF, an actively managed portfolio of taxable intermediate-duration bonds,

CleanSpark Purchases More Mining Rigs

📈ClearSpark (NASDAQ: CLSK) announced it has purchased 22,680 Bitmain mining rigs bringing its total planned mining production capacity to 3.2 Ehash/s by October 2022.

Soc Gen Issues EMTN on Blockchain

Societe Generale announced the launched of a tokenized euro dominated medium term note (EMTN) demonstrating “the legal, regulatory and operational feasibility of issuing more complex financial instruments (structured products) on [a] public blockchain.”

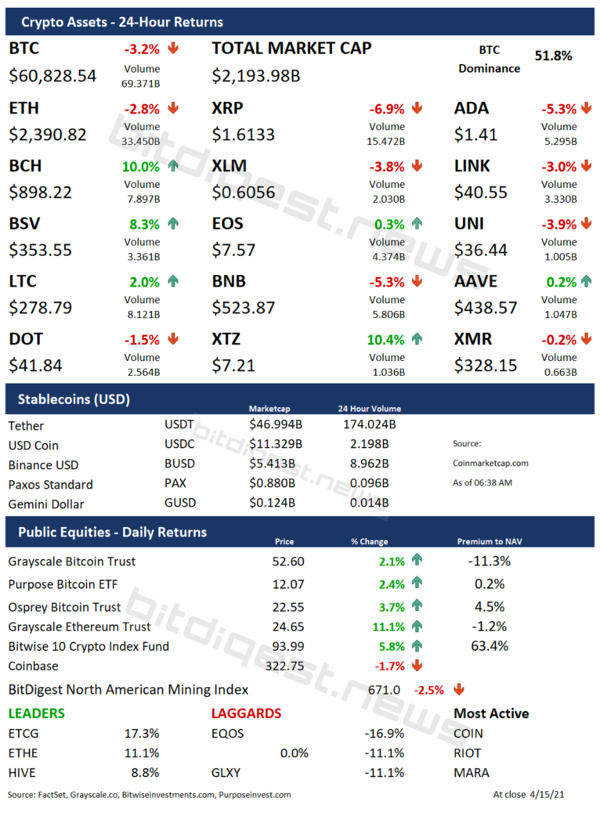

Market Data

Free Access to SEC Chairman's Crypto Course

Before being elected Chairman of the Securities and Exchange Commission, Gary Gensler taught a MOOC (massive open online course) on digital currencies and blockchain technology at MIT. Decript provided a link to the course site providing free online access for any curious student (or BitDigest reader).

Thoughts on the Ecosystem

Larry Fink is 'Fascinated' by Crypto

📺BlackRock CEO Larry Fink is “fascinated” and “encouraged by how many people are focusing on” digital currencies and believes “this could become a great asset class,” but is not receiving “broad based interest from institutions worldwide” and does not believe “this is a substitute for currencies.”

In order to unsubscribe, click here.

If you were forwarded this newsletter and you like it, you can subscribe here.

Created with Revue by Twitter.

BitDigest is a weekday news update on digital currencies and blockchain technology for friends and partners of Parsons & Whittemore, a single family office based in Rye Brook, New York. Receipt of BitDigest is by approval of the Author. The commentary, analysis, opinions and recommendations in this newsletter represent the personal and subjective views of the Author, and are subject to change at any time without notice. The information provided in this newsletter is obtained from sources which the Author believes to be reliable. However, the Author has not independently verified or otherwise investigated all such information. Neither the Author nor any of the Author's affiliates make any guarantee or other promise as to any results that may be obtained from reading this newsletter. While past performance may be analyzed in this newsletter, past performance should not be considered indicative of future performance. No reader should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. The Author is not making a solicitation or offer to buy or sell any securities of any kind.