BitDigest - Friday April 13, 2018

Just as the Wall Street Journal was reporting that bitcoin’s (BTC) hype had ‘vanished,’ declaring daily trading volume was 70% lower than most active days, the market responded with BTC trading $1.2 billion in less than an hour – more than any other time in the history of the digital currency.

BTC shorts were ‘squeezed’ triggered by an all-time-high in number of downward looking contracts as investors were front running the supposed April 15th tax deadline. The market responded to this excess demand by driving BTC up $1,000 as traditional markets opened yesterday. Other digital currencies followed and crypto markets had their best 24-hours in several weeks. Out of the top 100 currencies according to coinmarketcap.com, only AELF, a decentralized, cloud computing network, is down over 24-hours.

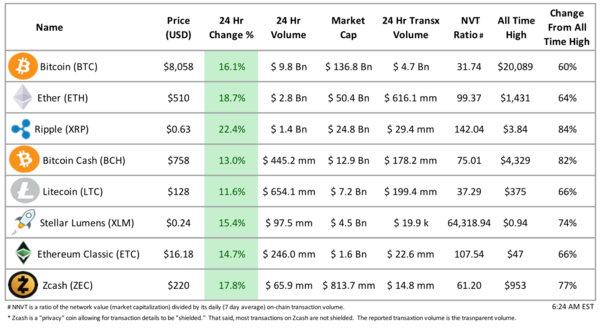

This was really a trading volume driven story as the top three digital currencies by market cap, BTC, ether (ETH), and ripple (XRP) had tremendous increases jumping 88%, 75% and 137% respectively. BTC added $20 billion to its market cap over 24-hours while ETH added $9 billion. While activity in BTC definitely sparked this move, altcoins across the board followed; even with its significant increase, BTC’s market dominance declined, dropping to 46.5%

Cash settled BTC future activity followed the token settled markets, reporting an 86% increase in individually weighted BTC volume overnight. All Cboe and CME contracts that have traded since yesterday’s close are posting above $8,000 levels. June CME contracts are trading up 6% to $8,200. CME September contracts settled yesterday afternoon at $7,775 and have not had any activity since.

* * * * * * * * * *

Moody’s believes that blockchain technology could help cut costs and redundancies across the US mortgage industry to the tune of $1 billion in savings. They suggest a sizable opportunity for blockchain applications will be to “streamline key mortgage processes, eliminate redundancies and reduce costs.” Moody’s argues that the new technology can improve monitoring of loan performance by boosting the degree of transparency throughout a mortgage’s lifecycle, allowing “mortgage insurers to transfer discrete mortgage credit risks to reinsurers and other alternative capital providers on a cost-effective basis.”

* * * * * * * * * *

Responding to questions about its possible addition to Coinbase, Ripple expressed that its XRP token is not a security. “We absolutely are not a security. We don’t meet the standards for what a security is based on the history of court law,” Ripple’s chief market strategist, Cory Johnson said. XRP has long been rumored as the next addition to Coinbase’s exchange, but concerns that most tokens are actually securities has made many question if this is a reason why the highly valued token is not yet trading on the US leading exchange.

* * * * * * * * * *

Binance is not only the largest digital currency exchange, the 12-month old business has also become a leader among its peers. Hong Kong based OKEx, the fourth largest virtual currency exchange based on trading volume, has announced it is following Binance in developing their operations on the Mediterranean island of Malta. Chris Lee, CEO of OKEx, highlighted the crypto-friendly nation by lauding Malta’s “protection of [both] traders and the general public, compliance with Anti Money Laundering and Know Your Customer standards, and recognition of the innovation and importance of continued development in the Blockchain ecosystem.” Earlier in the year, Malta announced plans for the Malta Digital Innovation Authority, which aims to provide legal certainty for the use of blockchain technology, and by extension, digital currencies.

Curated News

Fox Business is reporting that the Securities and Exchange Commission has launched a massive crackdown on alleged fraud in cryptocurrency markets that could result in dozens of enforcement actions against companies and individuals in the next year over the sale and promotion of this burgeoning and under-regulated industry. The SEC crackdown is largely focused on initial coin offerings. It is the token offerings lack of transparency that has drawn scrutiny from the SEC, where Chairman Jay Clayton has made cracking down on abuse in this funding mechanism a top priority. “I would say the day of reckoning is coming in this area,” said Harvey Pitt, the former SEC Chairman under President George W. Bush. “And I think it reflects the deep-seated concern that some of the activity going on requires enforcement action that must be taken to prevent investors from being preyed upon.”

Venezuela Says Government Bodies Must Soon Accept Cryptocurrency

The Venezuelan government has issued a proclamation that its oil-backed cryptocurrency, the petro, will become the legal tender for all transactions involving government institutions – from ministries to airports – within 120 days. They also explained that the government will be the sole regulator of all crypto assets, and the newly created national Cryptocurrency Treasury will be in charge of overseeing everything from their emission to trading. President Nicolas Maduro already announced the introduction of ‘petro-zones’ where the digital tokens will be accepted at popular tourist destinations along the country’s western border.

Australia Sets Registration Deadline for Cryptocurrency Exchanges

The Australia’s financial intelligence agency, AUSTRAC, has followed on this week’s announcement reminding digital exchanges of their regulatory obligations by mandating them to register with the authority by the middle of May. “Effective immediately, DCEs (digital currency exchanges) with a business operation located in Australia must now register with AUSTRAC and meet the Government’s AML/CTF compliance and reporting obligations,” the authority said.

UAE Launches Blockchain 2021 Strategy

Sheikh Mohammed bin Rashid Al Maktoum, the Prime Minster of the United Arab Emirates formally launched ‘‘UAE Blockchain Strategy’ announcing that the UAE has chosen to adopt blockchain technology as it becomes a global technology leader. “The adoption of [blockchain] technology will reflect on the quality of life in the UAE and will enhance happiness levels for citizens,” Sheikh Mohammed said. “50% of government transactions on the federal level will be conducted using blockchain technology by 2021,” he added, concluding that “this technology will save time, effort and resources and enable individuals to conduct most of their transactions in a timely manner that suits their lifestyle and work.”

Santander has launched ‘One Pay,’ the first blockchain-based, retail focused, international money transfer service across Spain, UK, Brazil and Poland. The new service is faster, making it possible for customers to complete international transfers on the same day in many cases. The service also shows them the exact amount that will be received in the destination currency before they make the transfer. The application is powered by Ripple’s xCurrent technology.

Yahoo Japan Buying Stake in Crypto Exchange

Yahoo Japan is entering the crtpto-sphere by buying a minority stake in a Tokyo-based cryptocurrency exchange. The company announced that through a subsidiary, it will be buying a 40% stake in BitARG Exchange Tokyo, with services planned for launch in the autumn. It is believed they are paying between 2 – 3 billion yen (around $20 – $25 million).

Pantera Capital Management has called $6,500 the probable low for bitcoin in the current bear market. The investment firm also said it was “highly likely” that bitcoin will hit new highs and exceed $20,000 within a year. “I rarely have such [a] strong conviction on timing,” Dan Morehead, chief executive and co-chief investment officer of Pantera, said, adding “a wall of institutional money will drive the markets much higher.”

Quote of the Day

“At its core, bitcoin is a smart currency, designed by very forward-thinking engineers. It eliminates the need for banks, gets rid of credit card fees, currency exchange fees, money transfer fees, and reduces the need for lawyers in transitions… all good things.”- Peter Diamandis, futurist and cofounder of Singularity University

In order to unsubscribe, click here.

If you were forwarded this newsletter and you like it, you can subscribe here.

Created with Revue by Twitter.

BitDigest is a weekday news update on digital currencies and blockchain technology for friends and partners of Parsons & Whittemore, a single family office based in Rye Brook, New York. Receipt of BitDigest is by approval of the Author. The commentary, analysis, opinions and recommendations in this newsletter represent the personal and subjective views of the Author, and are subject to change at any time without notice. The information provided in this newsletter is obtained from sources which the Author believes to be reliable. However, the Author has not independently verified or otherwise investigated all such information. Neither the Author nor any of the Author's affiliates make any guarantee or other promise as to any results that may be obtained from reading this newsletter. While past performance may be analyzed in this newsletter, past performance should not be considered indicative of future performance. No reader should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. The Author is not making a solicitation or offer to buy or sell any securities of any kind.